To calculate your bonus tax, it's essential to understand the tax implications of receiving a bonus. In most countries, bonuses are considered supplemental income and are subject to income tax. The tax rate applied to your bonus can vary depending on your tax bracket, the size of the bonus, and the tax laws in your country.

Understanding Bonus Tax Calculation

The calculation of bonus tax involves determining the tax rate that applies to your bonus income. This rate can be different from your regular income tax rate due to the supplemental nature of bonuses. In the United States, for example, the IRS requires employers to withhold a flat 22% for federal income taxes on supplemental wages, including bonuses, unless the bonus exceeds 1 million, in which case the rate increases to 37% for the amount above 1 million.

Tax Brackets and Bonus Tax

It’s crucial to consider your overall tax situation when receiving a bonus. If you’re in a higher tax bracket, more of your bonus might be subject to a higher tax rate. However, the actual tax withheld from your bonus might be less than your regular tax rate if your employer uses the supplemental wage method for withholding, which could result in a lower tax rate being applied to your bonus compared to your regular income.

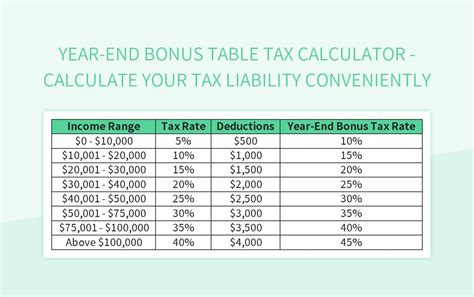

| Tax Bracket | Tax Rate |

|---|---|

| 10% | Single: $0 - $9,875 |

| 12% | Single: $9,876 - $40,125 |

| 22% | Single: $40,126 - $80,250 |

| 24% | Single: $80,251 - $164,700 |

| 32% | Single: $164,701 - $214,700 |

| 35% | Single: $214,701 - $518,400 |

| 37% | Single: $518,401 and above |

Calculating Your Bonus Tax

To calculate your bonus tax, follow these steps:

- Determine the amount of your bonus.

- Check your tax bracket based on your regular income.

- Apply the supplemental income tax rate (22% in the U.S. for bonuses below $1 million) to your bonus amount.

- Consider any state or local taxes that may apply to your bonus income.

- Consult with a tax professional to ensure you’re meeting all tax obligations and to explore any potential tax savings strategies.

Key Points

- Bonuses are subject to income tax, with rates varying by country and tax bracket.

- In the U.S., a flat 22% tax rate applies to bonuses below $1 million, unless the aggregate supplemental wages exceed $1 million in a calendar year.

- Understanding your tax bracket and the tax laws in your country is crucial for accurately calculating your bonus tax.

- Consulting a tax professional can help in navigating complex tax situations and ensuring compliance with tax laws.

- Bonus tax calculations should consider all applicable taxes, including federal, state, and local taxes.

Impact of Bonus Tax on Net Income

The tax on your bonus can significantly impact your net income from the bonus. For instance, if you receive a 10,000 bonus and 22% is withheld for federal income taxes, you would take home 7,800. Additional state or local taxes could further reduce your net bonus income.

In conclusion, calculating your bonus tax requires an understanding of your tax bracket, the tax laws applicable to supplemental income in your country, and any additional taxes that may apply. It's also important to consider the impact of bonus tax on your overall financial situation and to seek professional advice to optimize your tax strategy.

How is bonus tax calculated in the U.S.?

+In the U.S., bonus tax is typically calculated using a flat tax rate of 22% for federal income taxes on supplemental wages, including bonuses, unless the bonus exceeds 1 million, in which case the rate increases to 37% for the amount above 1 million.

Do state and local taxes apply to bonus income?

+Yes, state and local taxes may apply to bonus income, depending on the tax laws in your state or locality. These taxes can further reduce your net income from the bonus.

How can I minimize my bonus tax liability?

+Consulting with a tax professional can help you explore strategies to minimize your bonus tax liability, such as timing the receipt of your bonus, contributing to tax-deferred retirement accounts, or considering tax-loss harvesting in investment accounts.