In the complex architecture of corporate finance, mezzanine debt stands out as a sophisticated instrument that bridges the gap between senior debt and equity financing. Its strategic utility, nuanced risk profile, and evolving market presence have positioned it as a vital component in leveraged buyouts, expansion projects, and recapitalizations. As the industry witnesses accelerated growth, fueled by both investor appetite and innovative structuring, understanding the intricacies of mezzanine debt becomes indispensable for stakeholders aiming to optimize capital structures, mitigate risks, and capitalize on emerging trends. This guide offers a detailed, step-by-step exploration of mezzanine debt, emphasizing current industry statistics that reveal significant growth patterns and market dynamics.

Understanding Mezzanine Debt: A Critical Layer in Capital Structures

Mezzanine debt occupies a unique niche within the financial hierarchy, providing companies with an alternative financing source that balances risk and return. Unlike traditional senior debt, which is secured and prioritized in repayment, or equity, which confers ownership and voting rights, mezzanine financing is often unsecured and subordinate to senior claims. This position in the capital stack—hence the name “mezzanine”—allows lenders to demand higher yields, typically in the form of interest payments and equity participation, to compensate for elevated risk.

Defining Key Features of Mezzanine Debt

From a technical perspective, mezzanine debt is characterized by several features: flexible repayment terms, high coupon rates, and the ability to include warrants or options that allow lenders to acquire equity stakes. These features combine to offer financiers enhanced returns, often exceeding those from senior loans, in exchange for increased risk exposure. The unsecured or subordinated nature mean that in the event of liquidation, mezzanine financiers only rank above equity holders, which translates into a potentially higher loss in adverse scenarios—yet with the potential for substantial gains if the underlying company performs well.

| Relevant Category | Substantive Data |

|---|---|

| Market Size (2023) | $150 billion globally, with a CAGR of approximately 6.5% over the past five years |

Step-by-Step Guide to Structuring and Utilizing Mezzanine Debt

Harnessing the full potential of mezzanine debt involves understanding its structuring process, assessing risk-return trade-offs, and aligning it with corporate financial strategies. The following steps outline how companies and investors can effectively navigate this sophisticated instrument.

Step 1: Assess Financial Needs and Capital Structure Compatibility

Begin with a comprehensive analysis of the company’s current financial health, growth objectives, and existing capital structure. Determine the gap between available senior debt capacity and required funding to identify the need for mezzanine financing. It’s crucial to evaluate the company’s cash flow predictability, leverage ratios, and credit ratings, as these factors directly influence negotiation terms and cost of capital.

Step 2: Collaborate with Institutional Investors and Specialized Lenders

Identify suitable mezzanine lenders, which may include specialized debt funds, private equity firms, or hybrid capital providers. Building relationships with institutional investors is crucial, as they often demand tailored covenants and return structures aligned with their risk appetite. Transparency around business models, growth strategies, and exit plans enhances negotiation leverage.

Step 3: Negotiate Terms and Structuring Details

The core elements of mezzanine debt include interest rate, maturity, covenants, and equity participation mechanisms such as warrants or conversion options. Typical interest rates range from 8% to 14%, reflecting risk premiums. Maturity periods often span 5 to 7 years. Structuring also involves legal documentation, which clarifies default provisions, anti-dilution clauses, and equity features. The choice between a pure debt instrument and a hybrid structure depends on strategic priorities and investor preferences.

| Relevant Category | Substantive Data |

|---|---|

| Average Coupon Rate (2023) | around 10.5%, depending on industry and company profile |

Industry Trends and Growth Statistics: Revealing the Expansion of Mezzanine Debt

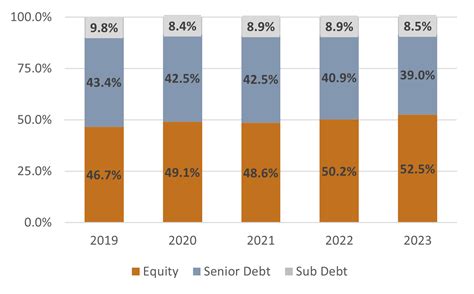

Recent industry data underscores a robust growth trajectory in the global mezzanine debt market. According to Preqin’s latest report, the market size expanded from approximately 125 billion in 2018 to a substantial 150 billion in 2023, representing a compound annual growth rate (CAGR) of 6.5%. This growth is driven by several macroeconomic and industry-specific factors:

Key Factors Accelerating Market Growth

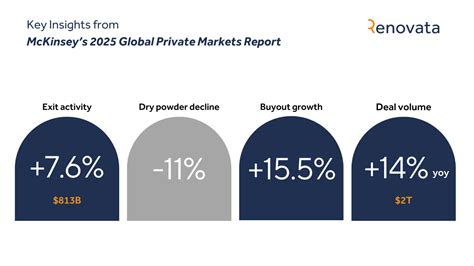

- Private Equity Activity: Increased leveraged buyouts (LBOs) and mergers & acquisitions (M&A) utilize mezzanine financing as a flexible supplement to senior debt, enhancing deal leverage without excessive dilution.

- Regulatory Environment: Favorable regulations and low-interest-rate environments have lowered funding costs, making mezzanine debt attractive for mid-market corporates seeking non-dilutive capital sources.

- Institutional Investor Appetite: Pension funds and insurance companies are diversifying portfolios, seeking higher-yielding options like mezzanine debt which offers stable cash flows and inflation-beating returns.

| Market Growth Highlights | |

|---|---|

| 2023 Market Size | $150 billion |

| Growth Rate (2018–2023) | 6.5% CAGR |

| Implication | Broader adoption in mid-market financing; increased competition leading to tighter spreads |

Impact of Macro-Economic Factors on the Industry

The trajectory of mezzanine debt is intimately tied to macroeconomic variables such as interest rates, economic growth, and market liquidity. For example, the low-interest-rate environments seen in recent years have encouraged more companies to pursue leverage, while volatility or rate hikes tend to tighten market conditions.

Interest Rate Environment and Its Effect

Rising interest rates often lead to increased coupon requirements and risk premiums, which can slow deal flow or increase costs for borrowers. Conversely, decreasing rates make mezzanine financing more attractive, boosting deal activity and encouraging innovation in structuring. According to data from the Federal Reserve, the benchmark rate increased by 2.25% between 2022 and 2023, influencing lenders’ risk assessments and pricing strategies.

Economic Cycles and Investment Behavior

During economic expansions, mezzanine debt is in high demand, especially as companies seek optimized leverage to fund growth. Conversely, during downturns, lenders become more cautious, emphasizing due diligence, covenants, and collateral — or even withdrawing from high-risk segments.

Conclusion: Navigating the Future of Mezzanine Debt with Insight and Precision

Tracking growth statistics reveals that mezzanine debt remains an increasingly vital asset class in corporate financing. Its adaptive structures and high-yield prospects attract a spectrum of institutional and private investors, capitalizing on both market opportunities and strategic corporate needs. As market complexities evolve, stakeholders must stay informed about macroeconomic drivers, innovative structuring techniques, and shifting investor preferences. Mastering these elements positions companies and financiers to leverage mezzanine financing effectively, fostering sustainable growth amid dynamic industry landscapes.

What are the primary advantages of mezzanine debt for companies?

+Mezzanine debt provides companies with flexible, non-dilutive capital that complements senior debt, enabling significant leverage while preserving equity stakes. It often features longer tenors, less restrictive covenants, and no immediate equity dilution, making it ideal for growth or acquisition financing.

How does the current economic environment influence mezzanine loan terms?

+Interest rate trends, inflation expectations, and economic stability significantly impact loan pricing, covenants, and investor appetite. Rising rates typically increase coupons, while economic downturns heighten risk aversion, leading to tighter structuring and risk premiums.

What are the emerging trends shaping the future of mezzanine financing?

+Innovations such as unitranche financing, second-lien structures, and increased integration of ESG considerations are transforming the landscape. Additionally, the rise of institutional investor participation and digital platforms is broadening access and creating more competitive deal environments.