A subsidized loan is a type of loan where the interest is paid or subsidized by a third party, typically the government or an organization, on behalf of the borrower. This type of loan is often provided to students, low-income individuals, or small businesses that may not have the financial resources to pay the interest on a loan. The subsidy can be in the form of a grant, a tax credit, or a direct payment to the lender.

In the context of student loans, subsidized loans are a popular option for undergraduate students who demonstrate financial need. The U.S. Department of Education, for example, offers subsidized loans through the Federal Direct Loan Program. These loans, also known as Direct Subsidized Loans, are available to eligible undergraduate students who are enrolled at least half-time in a degree-granting program. The interest on these loans is paid by the federal government while the student is in school and during periods of deferment.

How Subsidized Loans Work

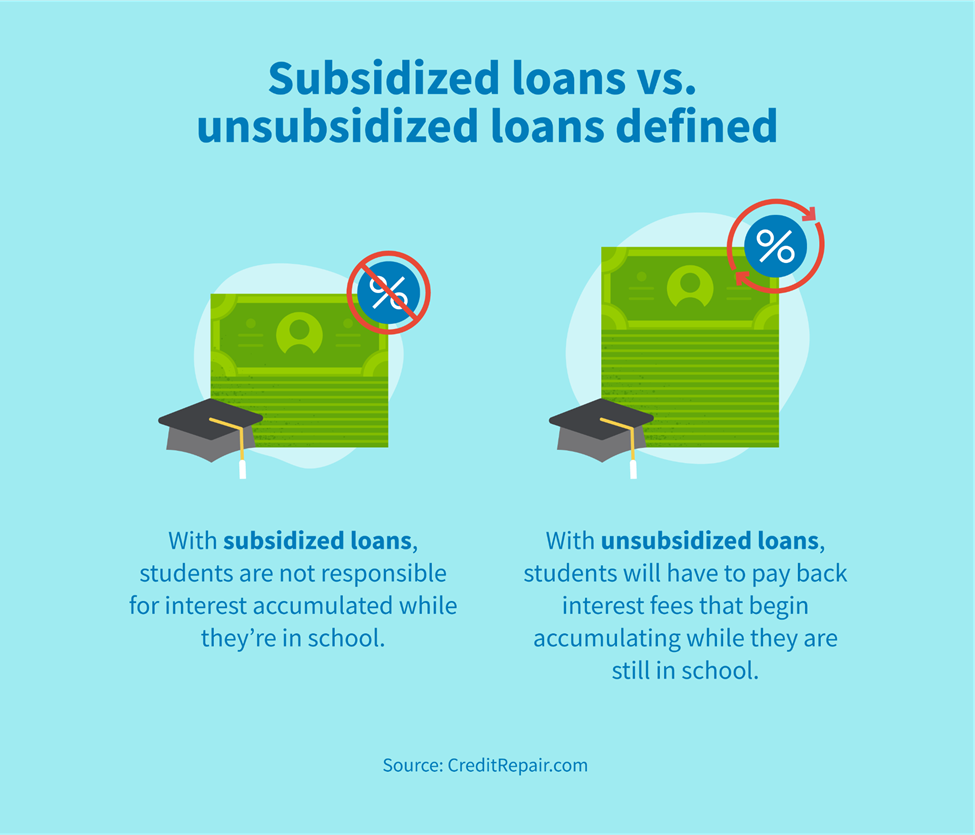

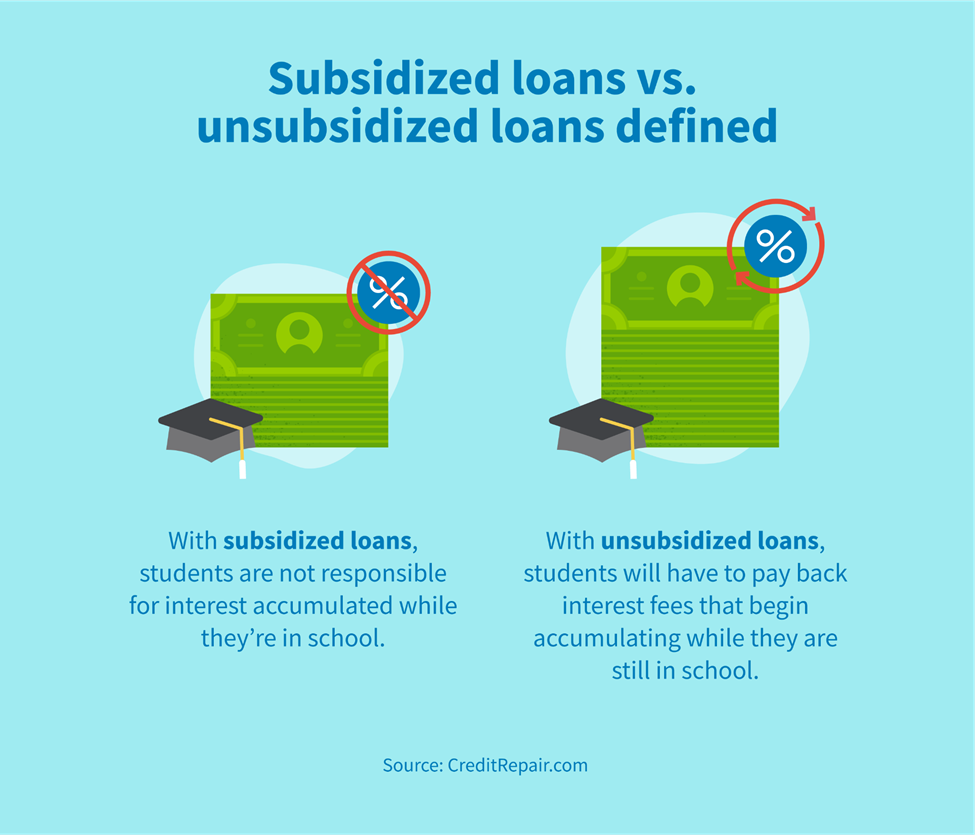

Subsidized loans work by having the third party, typically the government, pay the interest on the loan while the borrower is in a period of eligible repayment deferment. This means that the borrower is not responsible for paying the interest on the loan during this time, which can help reduce the overall cost of the loan. For example, if a student takes out a subsidized loan to attend college, the federal government will pay the interest on the loan while the student is in school and during the six-month grace period after graduation.

The borrower is still responsible for repaying the principal amount of the loan, plus any interest that accrues after the deferment period ends. Subsidized loans often have more favorable terms than unsubsidized loans, including lower interest rates and more flexible repayment options. However, the borrower must meet certain eligibility requirements to qualify for a subsidized loan, such as demonstrating financial need or meeting specific income thresholds.

Types of Subsidized Loans

There are several types of subsidized loans available, including:

- Federal Direct Subsidized Loans: These loans are available to undergraduate students who demonstrate financial need and are enrolled at least half-time in a degree-granting program.

- Federal Perkins Loans: These loans are available to undergraduate and graduate students who demonstrate exceptional financial need and are enrolled at least half-time in a degree-granting program.

- Subsidized Stafford Loans: These loans are available to undergraduate and graduate students who demonstrate financial need and are enrolled at least half-time in a degree-granting program.

Each type of subsidized loan has its own eligibility requirements and terms, so it's essential to review the specific details of each loan program before applying.

| Loan Type | Interest Rate | Eligibility Requirements |

|---|---|---|

| Federal Direct Subsidized Loans | 3.73% | Undergraduate students who demonstrate financial need |

| Federal Perkins Loans | 5% | Undergraduate and graduate students who demonstrate exceptional financial need |

| Subsidized Stafford Loans | 4.53% | Undergraduate and graduate students who demonstrate financial need |

Key Points

- Subsidized loans have the interest paid by a third party, typically the government or an organization, on behalf of the borrower.

- Subsidized loans are often available to students, low-income individuals, or small businesses that demonstrate financial need.

- The interest subsidy can be in the form of a grant, a tax credit, or a direct payment to the lender.

- Subsidized loans have more favorable terms than unsubsidized loans, including lower interest rates and more flexible repayment options.

- Borrowers must meet specific eligibility requirements to qualify for a subsidized loan, such as demonstrating financial need or meeting income thresholds.

Benefits of Subsidized Loans

Subsidized loans offer several benefits to borrowers, including:

Lower Interest Rates: Subsidized loans often have lower interest rates than unsubsidized loans, which can help reduce the overall cost of the loan.

More Flexible Repayment Options: Subsidized loans may offer more flexible repayment options, such as income-driven repayment plans or deferment periods, which can help borrowers manage their debt more effectively.

Reduced Debt Burden: By having the interest paid by a third party, subsidized loans can help reduce the debt burden on borrowers, making it easier for them to repay the loan.

Increased Access to Education: Subsidized loans can help make education more accessible to students who may not have the financial resources to attend college or university.

Drawbacks of Subsidized Loans

While subsidized loans offer several benefits, there are also some drawbacks to consider:

Eligibility Requirements: Subsidized loans have strict eligibility requirements, which can limit access to these loans for some borrowers.

Annual Limits: Subsidized loans are subject to annual limits, which can limit the amount of funding available to borrowers.

Repayment Obligations: Borrowers are still responsible for repaying the principal amount of the loan, plus any interest that accrues after the deferment period ends.

What is the difference between a subsidized loan and an unsubsidized loan?

+A subsidized loan has the interest paid by a third party, typically the government or an organization, on behalf of the borrower, while an unsubsidized loan requires the borrower to pay the interest on the loan.

Who is eligible for a subsidized loan?

+Subsidized loans are typically available to undergraduate students who demonstrate financial need and are enrolled at least half-time in a degree-granting program.

How do I apply for a subsidized loan?

+To apply for a subsidized loan, you must complete the Free Application for Federal Student Aid (FAFSA) and meet the eligibility requirements for the loan program.

In conclusion, subsidized loans can be a valuable resource for borrowers who demonstrate financial need and are seeking to finance their education or other expenses. While these loans offer several benefits, including lower interest rates and more flexible repayment options, they also have some drawbacks, such as strict eligibility requirements and annual limits. By understanding the terms and conditions of subsidized loans, borrowers can make informed decisions about their financing options and manage their debt more effectively.