Investor's Corner

Wall Street explains why they are bullish on Musk-Trump alliance

Morgan Stanley analyst Adam Jonas released a new research note clarifying why he raised the target price for Tesla Motors (TSLA) to $305 per share. Jonas warns investors who have equated Elon Musk’s new relationship with Donald Trump with a higher stock price. “There is no way to quantify the value (if any) of Tesla management’s advisory relationship with the new administration,” Jonas said.

Instead, Jonas emphasized the congruence between Trump’s desire for American workers to build products in American factories and Tesla’s business model which does both. Tesla is a leader in the automotive segment in both categories. “When you look at the businesses Tesla is in, you see many areas of overlapping interest” with the Trump administration, Adam Jonas told New York Times correspondent James Stewart on Friday. “To the extent the new administration prioritizes the creation of valuable, innovative high tech and manufacturing jobs, Tesla stands at the epicenter of that.”

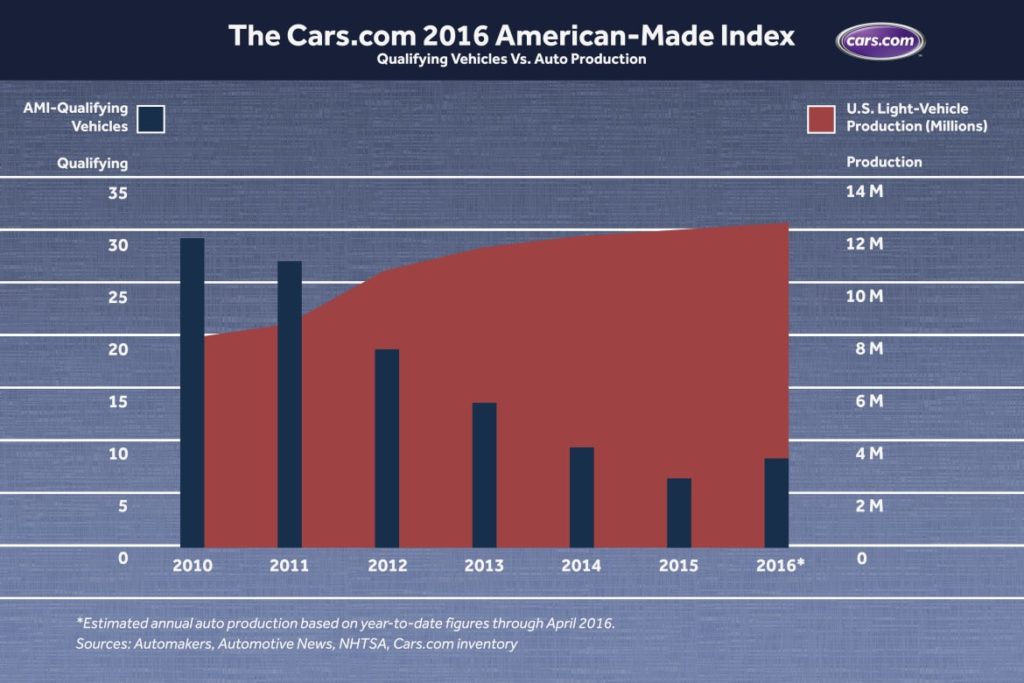

In fact, the auto industry manufactures relatively few cars that can be truly called “US Made.” According to a chart compiled by Cars.com last year, the number of models of light duty vehicles that qualify for that label has fallen precipitously in recent years from nearly 30 in 2010 to only 8 in 2016.

Another analyst weighing on the Musk-Trump connection is Andrew Hughes, an alternative energy analyst for Credit Suisse. Hughes said solar investors “aren’t nearly as negative as they were the day after the election.” In part, that is because solar power — which up until now has needed significant federal incentives to survive — has become so inexpensive, particularly with regard to coal, that many industry observers think it will survive on its own even if those incentives are eliminated by the Trump administration.

Despite Donald Trump’s antipathy to renewable energy, business is all about the bottom line. If solar costs less than coal, then business is going to switch to solar no matter what the president has to say. Elon Musk is also heavily involved in re-imagining the role of the electrical grid. He sees battery storage as the key to making the grid compatible with renewables like solar and wind.

Musk has gone head-to-head with utility companies, including NV Energy, which is owned by Warren Buffett’s Berkshire Hathaway company. In 2016, Musk and SolarCity lost a round when the Nevada PUC enacted new rules imposing monthly assessments on people with rooftop solar systems. In return, SolarCity terminated its operations in the state, laying off hundreds of local workers.

Nevertheless, Musk expects both Tesla with its grid scale batteries and SolarCity with its rooftop systems — including the revolutionary Solar Roof — to play an ongoing part in how people get their electricity in the future. Last fall, just prior to unveiling the Solar Roof, Musk said, “The solution is both local power generation and utility power generation — it’s not one or the other”. He went on to suggest that the proper mix would be about one third residential rooftop power and two thirds power from traditional utility companies.

The US Energy Department stated in its annual energy and jobs report issues earlier this month that “solar technologies, both photovoltaic and concentrated, employ almost 374,000 workers, or 43 percent of the electric power generation work force.” Compare that to the number of workers employed to make electricity from coal. That number is just 86,000 workers. “The jobs data is a compelling argument in favor of the tax credits,” Andrew Hughes said. “I want to believe that Trump won’t kill solar, but there’s still a lot of uncertainty. The big question: Will he take away the tax credits?”

Musk received plenty of blowback when he decided to endorse former CEO of ExxonMobil Rex Tillerson for the position of Secretary of State. That makes him the public face of the fossil fuel industries and theoretically a natural adversary for Musk and his commitment to zero emissions energy. But Elon thinks Tillerson can temper some of the president’s more outrageous plans to extract every last molecule of fossil fuel that can be found on the planet.

Tillerson also advocates for a carbon tax, an idea that Musk strongly supports. According to reports, Musk floated the carbon tax idea at last week’s meeting of business advisors to the president. While Donald Trump did not dismiss the idea out of hand, Musk found little to no support from others in the room.

Trump likes to think big and take bold actions. So does Elon Musk. In some ways, it’s easy to see why the two men might take a liking to each other. Trump is especially interested in space exploration, something that fits perfectly with Musk’s passion for establishing a human colony on Mars.

Job creation in America for American workers, rebooting the traditional utility grid to use modern technology, sending people off to live on other planets. These are all things that interest both men. But cozying up to Trump also exposes Musk to dissatisfaction with some of the president’s less popular plans, like building walls with neighboring countries, sending federal troops into American cities, and banning immigration by people who espouse certain religions. To be successful, Tesla will need a broad base of customers. Musk has been careful to avoid political involvement so far. His association with the new president exposes him to new dangers.

One gets the sense that Musk is willing to accept some of the negatives if he can make progress on his passion for a carbon tax. But if that idea is stymied by Trump and his advisors, Elon’s desire to work with the new administration may cool considerably. Perhaps the most danger comes from the unpredictability and volatility of the new president, who can change course in a heartbeat. Musk will be need to be nimble to avoid getting rolled over by Trump in the future.

The president is scheduled to meet with his council of business leaders today, at which time he says he will provide details about his plant to cut government regulation of business by “75% or more.” That will give Musk yet another chance to evaluate the business acumen of Donald Trump and decide whether his involvement with his plans will pay dividends for him and the companies he leads. As Adam Jonas said in his report, it is impossible to predict how the association between Trump and Musk will benefit either.

Investor's Corner

Tesla is ‘better-positioned’ as a company and as a stock as tariff situation escalates

Tesla is “better-positioned” as a company and as a stock as the tariff situation between the United States, Mexico, and Canada continues to escalate as President Donald Trump announced sanctions against those countries.

Analysts at Piper Sandler are unconcerned regarding Tesla’s position as a high-level stock holding as the tariff drama continues to unfold. This is mostly due to its reputation as a vehicle manufacturer in the domestic market, especially as it holds a distinct advantage of having some of the most American-made vehicles in the country.

Analysts at the firm, led by Alexander Potter, said Tesla is “one of the most defensive stocks” in the automotive sector as the tariff situation continues.

The defensive play comes from the nature of the stock, which should not be too impacted from a U.S. standpoint because of its focus on building vehicles and sourcing parts from manufacturers and companies based in the United States. Tesla has held the distinct title of having several of the most American-made cars, based on annual studies from Cars.com.

Its most recent study, released in June 2024, showed that the Model Y, Model S, and Model X are three of the top ten vehicles with the most U.S.-based manufacturing.

Tesla captures three spots in Cars.com’s American-Made Index, only U.S. manufacturer in list

The year prior, Tesla swept the top four spots of the study.

Piper Sandler analysts highlighted this point in a new note on Monday morning amidst increasing tension between the U.S. and Canada, as Mexico has already started to work with the Trump Administration on a solution:

“Tesla assembles five vehicles in the U.S., and all five rank among the most American-made cars.”

However, with that being said, there is certainly the potential for things to get tougher. The analysts believe that Tesla, while potentially impacted, will be in a better position than most companies because of their domestic position:

“If nothing changes in the next few days, tariffs will almost certainly deal a crippling blow to automotive supply chains in North America. [There is a possibility that] Trump capitulates in some way (perhaps he’ll delay implementation, in an effort to save face).”

There is no evidence that Tesla will be completely bulletproof when it comes to these potential impacts. However, it is definitely better insulated than other companies.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla gets price target boost from Truist, but it comes with criticism

Tesla (NASDAQ: TSLA) received a price target boost from analysts at Truist Securities, but it came with some criticisms based on a lack of information on several things that investors were excited to hear about regarding future vehicles and AI achievements.

Last night, Tesla reported its earnings from the fourth quarter of 2024, and while it had a very tempered financial showing, missing most of the Wall Street targets that were set for it, the stock was up after hours and on Thursday due to the details the company released regarding its plans for 2025.

CEO Elon Musk stunned listeners last night by revealing plans to launch unsupervised Full Self-Driving as a service in Austin in June 2025. It will be the first time Tesla will offer driverless FSD rides in public, something it has been working with the City of Austin on since December.

Tesla to launch unsupervised Full Self-Driving as a service in Austin in June

It also reiterated plans for affordable models to be launched this year, potentially catalyzing annual growth in deliveries, something it said it expects to resume in 2025.

Tesla was flat on deliveries in 2024 compared to 2023.

The positives during the call were enough for Truist Securities analyst William Stein to raise the company’s price target to $373 from $351. However, Stein’s note to investors showed there was something to be desired despite all the good that was revealed during the call:

Stein said there was “not enough ground-truth” during the call and too much of a focus on “cheerleading” the company’s potential releases this year:

“Too much cheerleading; not enough ground-truth. In Q4, TSLA’s ASP weakness drive revenue, GPM, OPM, & EPS below consensus.”

As previously mentioned, Tesla did report weak financials that missed consensus estimates. What saved the call and perhaps the stock from plummeting on these missed metrics was the other details that Musk revealed, especially the FSD launch in Austin in June.

There were also plenty of things related to the affordable models and other vehicles, like the fact that Tesla plans to include things like Steer by Wire, Adaptive Air Suspension, and Rear Wheel Steering, that helped offset negatives.

Stein saw this as a distraction from what should have been reported:

“While CEO Elon Musk played the role of cheerleader, calling for TSLA’s path to massive market cap by leading in autonomy, management was remarkably short on two critical details: (1) info about new vehicles in 2025 and (2) milestones for AI acheivements, especially FSD. We continue to ask ourselves ‘where’s the beef?’ CY26 EPS to $3.99 (from $4.87). DCF-derived PT to $373 (from $351).”

Tesla did detail some AI milestones, like its record-breaking miles per accident on Autopilot, which was a Q4-best of 5.94 million miles. The Shareholder Deck also outlined major upgrades to AI:

“In Q4, we completed the deployment of Cortex, a ~50k H100 training cluster at Gigafactory Texas. Cortex helped enable V13 of FSD (Supervised)1, which boasts major improvements in safety and comfort thanks to 4.2x increase in data, higher resolution video inputs, 2x reduction in photon-to-control latency and redesigned controller, among other enhancements.”

Tesla shares are up 2.11 percent on Thursday as of 12:05 p.m. on the East Coast.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla posts Q4 2024 vehicle safety report

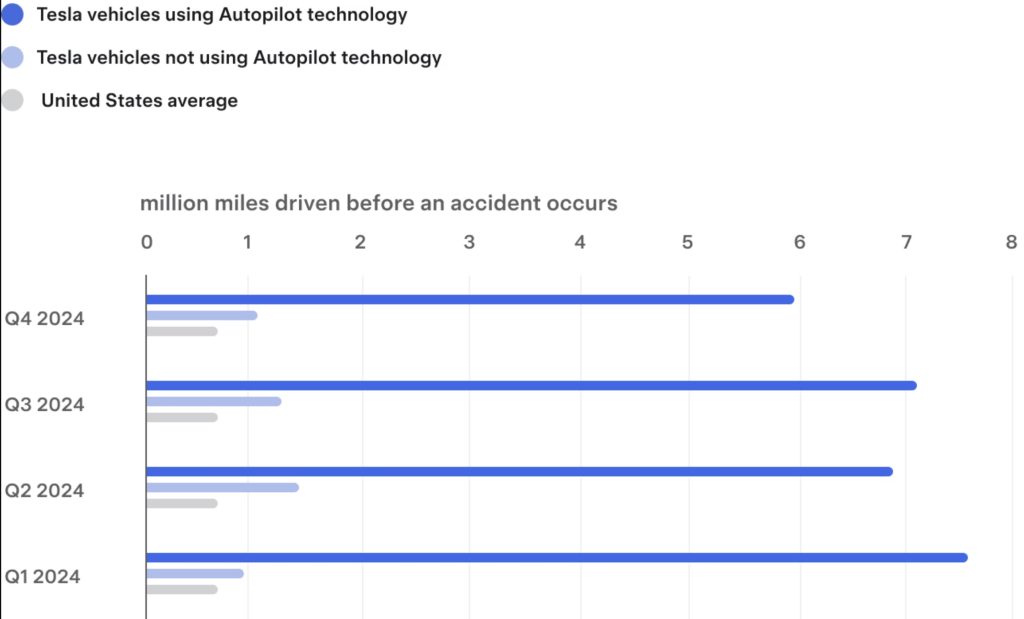

Tesla has released its Q4 2024 vehicle safety report. Similar to data from previous quarters, vehicles that were operating with Autopilot technology proved notably safer.

The Q4 2024 report:

- As per Tesla, it recorded one crash for every 5.94 million miles driven in which drivers were using Autopilot technology.

- The company also recorded one crash for every 1.08 million miles driven for drivers who were not using Autopilot technology.

- For comparison, the most recent data available from the NHTSA and FHWA (from 2023) showed that there was one automobile crash every 702,000 miles in the United States.

Previous safety reports:

- In Q3 2024, Tesla recorded one crash for every 7.08 million miles driven in which drivers were using Autopilot technology and one crash for every 1.29 million miles driven by drivers not using Autopilot technology.

- In Q2 2024, Tesla recorded one crash for every 6.88 million miles driven in which drivers were using Autopilot technology, and one crash for every 1.45 million miles driven for drivers not using Autopilot technology.

- In Q1 2024, Tesla recorded one crash for every 7.63 million miles driven in which drivers were using Autopilot technology, and one crash for every 955,000 million miles driven for drivers not using Autopilot technology.

Year-over-Year Comparison:

- In Q4 2023, Tesla recorded one crash for every 5.39 million miles driven in which drivers were using Autopilot technology and one crash for every 1.00 million miles driven for drivers not using Autopilot technology.

Key background:

- Tesla began voluntarily releasing quarterly safety reports in October 2018 to provide critical safety information about our vehicles to the public.

- On July 2019, Tesla started voluntarily releasing annual updated data about vehicle fires as well.

- It should be noted that accident rates among all vehicles on the road can vary from quarter to quarter and can be affected by seasonality, such as reduced daylight and inclement weather conditions.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.