Tesla’s (NASDAQ:TSLA) third-quarter earnings call comes on the heels of an impressive quarter that saw the electric car maker posting $8.771 billion in revenue and $809M GAAP operating income, beating Wall Street’s estimates once more. With these results, Tesla has now posted five consecutive profitable quarters.

As revealed in the company’s Q3 2020 Update Letter, Tesla currently sits on $5.9 billion in cash. This is despite the company’s simultaneous construction of Gigafactory Shanghai, Gigafactory Berlin, and Gigafactory Texas. Impressively enough, Model 3 and Model Y production have reached a run-rate of 500,000 vehicles per year at the Fremont factory. This, together with the facility’s capability to produce 90,000 Model S and Model X annually, as well as Gigafactory Shanghai’s current 250,000-per-year capacity, allows Tesla to take a definitive step towards a run-rate of 1 million cars per year.

For today’s earnings call, Tesla executives are expected to address questions surrounding the company’s plans for the coming quarters, particularly its battery cell production strategy. Updates on future projects such as the Cybertruck, Semi, and Roadster may also be mentioned, as well as more details on the third quarter’s surprising Tesla Energy results.

The following are live updates from Tesla’s Q3 2020 earnings call. I will be updating this article in real-time, so please keep refreshing the page to view the latest updates on this story. The first entry starts at the bottom of the page.

15:35 PT: And that’s it for the Q3 2020 earnings call! Thanks so much for staying with us for yet another live blog. We will see you in the next one.

15:34 PT: Final question from Philippe Houchois from Jefferies, who asks about Tesla’s business model for stationary storage. Johnson notes that Tesla is already seeing how energy prices are already seeing benefits from products like the Megapack and Powerwall. Using the hardware and software platform in the form of Autobidder, Tesla Energy has tons of potential.

The analyst also asks about Tesla’s skateboard design, which Musk confirmed will be obsolete in the long term. Musk notes that Tesla is looking to make its vehicles kind of like the way a toy car is made, with large casts and few parts. Using batteries as part of the vehicle’s structure is used in aircraft and rockets, so this approach would likely work for cars too. With such a strategy, Tesla is literally borrowing from orbital-class rocket design philosophy.

“You wouldn’t want to put a box in a box,” Musk noted. He did state that the transition away from the skateboard design won’t happen overnight, but it is bound to happen.

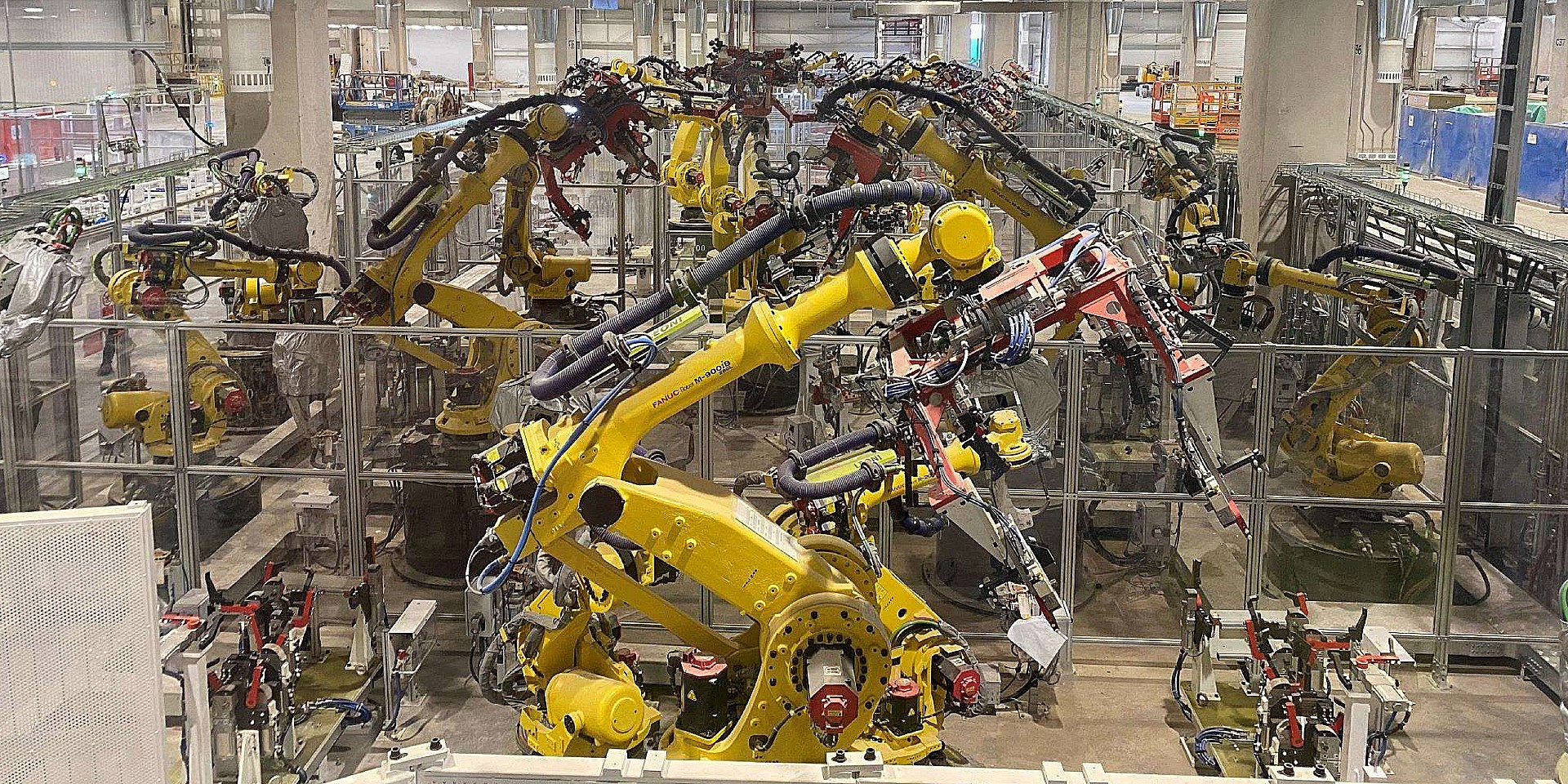

15:30 PT: Ben Kallo of Baird asks about OEMs and how they can get their act together. Elon notes that there will definitely be other car companies even after the EV age. He notes that Tesla designs and builds so much more of its cars than traditional OEMs. “It’s not very adventurous, and all the parts end up looking the same since they go to the same suppliers,” he said. “We’re probably an order of magnitude more vertically-integrated than other companies,” he adds.

Tesla is working on several parties to ensure that the Semi will have a legitimate charging infrastructure on the vehicle. “We’re not working in isolation,” Guillen noted.

Musk adds that the Semi consumes about 5-6x the cells of conventional cars. “We need to solve cell constraints,” the CEO states. When asked if the Semi and autonomy could be a material business, Musk stated that there is no doubt. Guillen added that the tech that Tesla is putting on the Semi is identical to the tech the company is putting on its other vehicles.

As a follow-up, Levy asked about Tesla’s strategy with pricing, especially with regards to Berlin-made vehicles. Kirkhorn explains that this is affected by different factors, though Tesla is trying to move production higher to optimize pricing.

15:20 PT: Pierre Ferragu of New Street Research asks about the Cybertruck and its ramp. Musk notes that he and the Tesla team are working hard on making sure that the Cybertruck will be better than the prototype that was unveiled last year. “We want the car we deliver to be better than the car we unveiled.” Musk notes that there are a “lot of small improvements” that have been made to the vehicle, making it better than its already-impressive prototype. “I think it’s going to be better than what we showed. It will be made in Austin,” he added.

Musk reiterates that the Cybertruck’s hard exoskeleton will likely present some challenges with the vehicle’s manufacturing. “But nevertheless, “if all goes well, we can do some Cybertruck deliveries towards the end of next year.” Musk predicts lots of deliveries in 2022 and the year after.

15:15 PT: Colin Rusch of Oppenheimer asks about Tesla’s processes and operations/equipment that are coming in-house. Musk notes that Tesla is “absurdly vertically integrated.” Tesla literally designs the machine, then the company makes the machine. “We made the machine that made the machine that made the machine. We’d like to outsource less,” Musk remarked. “This makes it quite difficult to copy Tesla,” he added. Musk admits that he’s not sure if insane vertical integration is a smart move, but so far, it appears that it is.

Musk is then asked about Tesla’s balance sheet, and how the company is looking to operate in the near future. “We’re trying to spend money at the fastest rate without wasting any of it,” Musk noted.

15:10 PT: Analyst questions begin. Wolfe Research is up first, asking about the targets that were announced during Battery Day. Elon noted that it’s difficult to predict Tesla’s actual output, but 20 million vehicles is a good number, representing 1% of the vehicles that are produced this year. Tesla has a mission to accelerate the advent of sustainability after all, and it needs volume to do that.

When asked about Tesla’s cell production, Musk noted that Tesla could and will change all aspects of the company’s battery cells. “We will change all aspects of the cell,” he said. Tesla will be exploring varying chemistries for its batteries over time. This is classic Tesla, in a way, as the electric car maker is still showing its tendency to continuously innovate.

15:05 PT: Elon highlights why making Tesla’s cars affordable is pivotal. “All of these margins will look comically small when you factor in Autonomy,” Musk said. Adding to the CEO’s statement, Kirkhorn stated that Tesla is moving full speed ahead with as much volume as possible. He adds that Tesla has grown volume and margins even with all the price reductions of Tesla’s vehicle lineup. In addition to reducing costs, the cars get better, and this becomes a reason for more consumers to purchase the company’s cars.

15:00 PT: A question from an institutional investor is brought up about Tesla’s HVAC plan, especially in light of the Model Y’s heat pump. Drew Baglino notes that the Model Y’s heat pump does provide Tesla with some background in this sense, and Elon Musk noted that the company has tech that should allow for home products to be developed.

14:58 PT: Shareholder questions begin with a question about the company’s 4680 cells and if they will be produced at the same time as vehicle ramp in Berlin, which Drew Baglino confirms will indeed be the case. As for the idea of FSD being carried over from one vehicle to the next, Elon Musk noted that Tesla will “give it some thought.”

An inquiry about Solar Roof installation constraints was also asked. According to Johnson, the main constraint today lies in the installers themselves. It is pertinent for Tesla to ensure that the Solar Roof is easy to install, and so far, the response from third-party installers have been positive. Elon Musk notes that Solar Roof’s true potential would likely be very evident next year.

In response to a question about the idea of one of Tesla’s businesses spinning off into its own company, Musk discusses how Tesla is essentially a series of startups. “Every major product line is a startup. Every big new plant is a startup. And frankly, sometimes we have to learn a lesson a few times before it sinks in,” Musk remarked. He also noted that “Tesla is not dependent on enterprise software,” implying that Tesla develops all of its operational software internally.

No plans to spin anything out yet though. “It just adds complexity,” Musk said.

14:50 PT: RJ Johnson of Tesla Energy takes the stage. He discusses how Tesla Energy is ramping. “We have more demand than supply through 2021,” he said. Megapack is seeing more demand over the following year. He notes that as costs go lower, sustainable technologies are poised to replace fossil fuel-powered solutions. Other Tesla Energy products such as Autobidder and Powerwall continue to find more adoption as well.

Solar Roof is exciting as the company is gaining more experience in installing the product quickly. Solar Roof installation’s record now stands at 1.5 days.

14:45 PT: To conclude, Musk thanks Tesla’s employees and suppliers. He also extends thanks to investors who have stuck with the company through thick and thin. “I’ve never felt more optimistic about Tesla than I do today,” Musk said.

Zach Kirkhorn takes the stage. He mentions how Tesla now has five profitable quarter. The company’s regulatory credit sales continue to be strong. And despite expenses being higher due to Elon Musk’s payout from his compensation plan, the company was able to keep its numbers strong just the same. Manufacturing and operational costs continue to decrease, as per the CFO.

14:41 PT: The CEO also highlights that the Autopilot rewrite is a generalized approach to FSD, meaning that there are no specialized sensors needed for the vehicles to operate themselves.

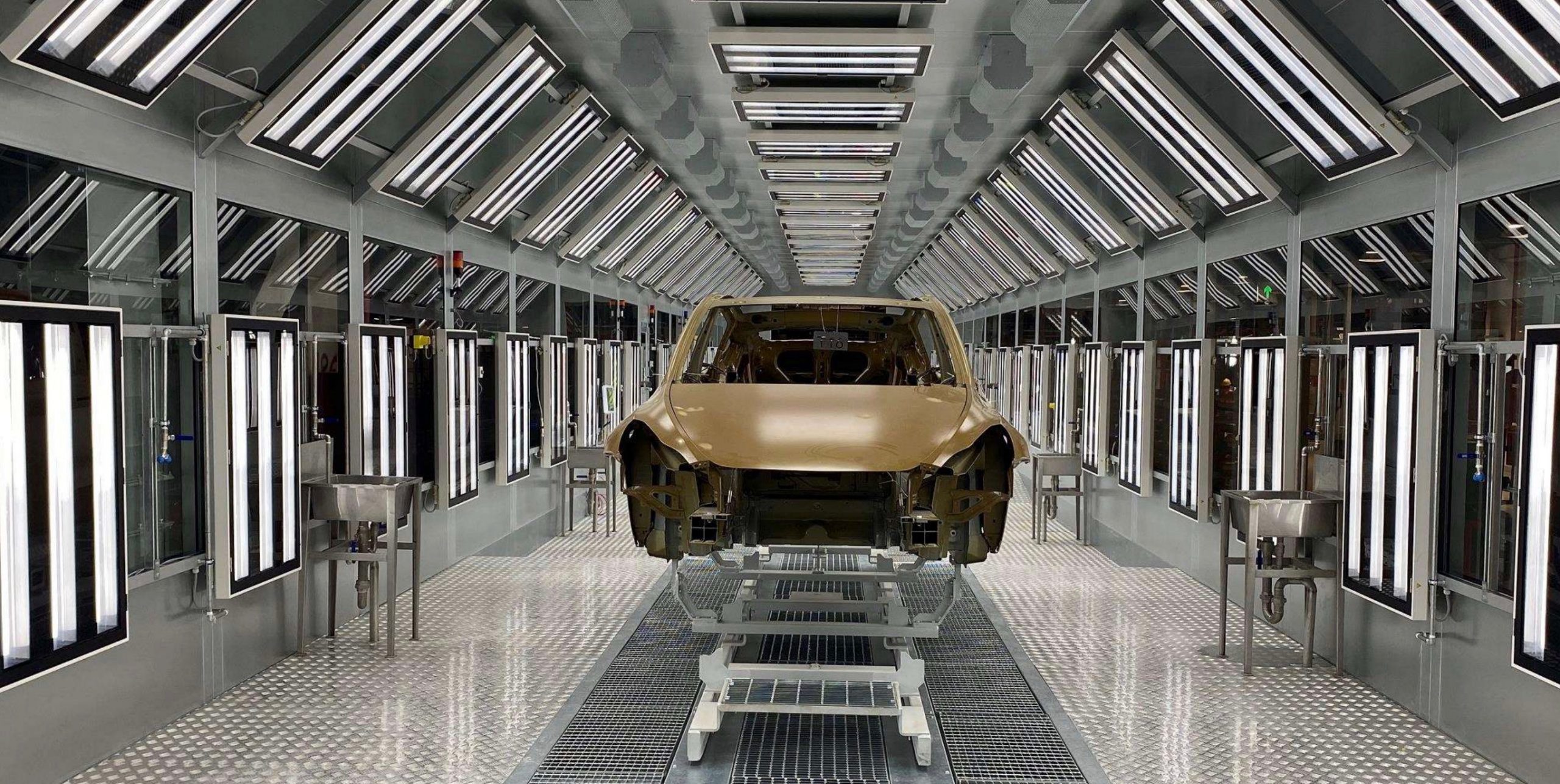

In terms of capacity, Elon mentions the expansion of Gigafactory Shanghai, Gigafactory Berlin, and Gigafactory Texas. “We’re making progress on three major factories,” he said, adding that “always impressed by how much the Tesla China team makes.” Musk also notes that Giga Berlin, due to the ramp of new technology, the production of the facility will start slow, and then ramp to greater outputs over time. Giga Berlin could take about 12-24 months to reach full production capacity.

14:36 PT: Elon talks about how Q3 is a record quarter for Tesla. Full Stop. “Q3 was our best quarter in history,” he said. The CEO also discusses Battery Day, the culmination of years’ worth of work by the company. Musk notes that in a few years, batteries could cost half as much with cheaper production costs.

Musk also discusses updates to the rollout of Full Self-Driving. He specifically extends his thanks to the Autopilot team, which has been working like crazy to release the highly-anticipated rewrite. Musk states that the Autopilot rewrite could roll out to more drivers this weekend, with wide release by the end of the year.

14:34 PT: And we’re off! Tesla Investor Relations’ Martin Viecha takes the floor. Just like previous calls, CEO Elon Musk and CFO Zachary Kirkhorn are present, as well as other Tesla executives. Here’s Elon’s opening remarks.

14:32 PT: Then again, Tesla posted $809M GAAP operating income in Q3. That’s more than enough to justify a little delay, I guess.

14:30 PT: And… It’s starting! Here we go, folks… Wait, scratch that. It’s back to classical music.

14:25 PT: I gotta admit, this classical music is getting more and more relaxing by the quarter.

14:20 PT: It is time once more for Tesla’s quarterly earnings report! This makes five consecutive profitable quarters for Tesla now, which is something that definitely did not seem to be on the horizon in early 2019. Back then, it seemed like TSLA was the punching bag of every bear and critic out there. But since Q3 2019, things have changed, a whole lot. Needless to say, this earnings call will definitely be interesting.

Investor's Corner

Tesla is ‘better-positioned’ as a company and as a stock as tariff situation escalates

Tesla is “better-positioned” as a company and as a stock as the tariff situation between the United States, Mexico, and Canada continues to escalate as President Donald Trump announced sanctions against those countries.

Analysts at Piper Sandler are unconcerned regarding Tesla’s position as a high-level stock holding as the tariff drama continues to unfold. This is mostly due to its reputation as a vehicle manufacturer in the domestic market, especially as it holds a distinct advantage of having some of the most American-made vehicles in the country.

Analysts at the firm, led by Alexander Potter, said Tesla is “one of the most defensive stocks” in the automotive sector as the tariff situation continues.

The defensive play comes from the nature of the stock, which should not be too impacted from a U.S. standpoint because of its focus on building vehicles and sourcing parts from manufacturers and companies based in the United States. Tesla has held the distinct title of having several of the most American-made cars, based on annual studies from Cars.com.

Its most recent study, released in June 2024, showed that the Model Y, Model S, and Model X are three of the top ten vehicles with the most U.S.-based manufacturing.

Tesla captures three spots in Cars.com’s American-Made Index, only U.S. manufacturer in list

The year prior, Tesla swept the top four spots of the study.

Piper Sandler analysts highlighted this point in a new note on Monday morning amidst increasing tension between the U.S. and Canada, as Mexico has already started to work with the Trump Administration on a solution:

“Tesla assembles five vehicles in the U.S., and all five rank among the most American-made cars.”

However, with that being said, there is certainly the potential for things to get tougher. The analysts believe that Tesla, while potentially impacted, will be in a better position than most companies because of their domestic position:

“If nothing changes in the next few days, tariffs will almost certainly deal a crippling blow to automotive supply chains in North America. [There is a possibility that] Trump capitulates in some way (perhaps he’ll delay implementation, in an effort to save face).”

There is no evidence that Tesla will be completely bulletproof when it comes to these potential impacts. However, it is definitely better insulated than other companies.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla gets price target boost from Truist, but it comes with criticism

Tesla (NASDAQ: TSLA) received a price target boost from analysts at Truist Securities, but it came with some criticisms based on a lack of information on several things that investors were excited to hear about regarding future vehicles and AI achievements.

Last night, Tesla reported its earnings from the fourth quarter of 2024, and while it had a very tempered financial showing, missing most of the Wall Street targets that were set for it, the stock was up after hours and on Thursday due to the details the company released regarding its plans for 2025.

CEO Elon Musk stunned listeners last night by revealing plans to launch unsupervised Full Self-Driving as a service in Austin in June 2025. It will be the first time Tesla will offer driverless FSD rides in public, something it has been working with the City of Austin on since December.

Tesla to launch unsupervised Full Self-Driving as a service in Austin in June

It also reiterated plans for affordable models to be launched this year, potentially catalyzing annual growth in deliveries, something it said it expects to resume in 2025.

Tesla was flat on deliveries in 2024 compared to 2023.

The positives during the call were enough for Truist Securities analyst William Stein to raise the company’s price target to $373 from $351. However, Stein’s note to investors showed there was something to be desired despite all the good that was revealed during the call:

Stein said there was “not enough ground-truth” during the call and too much of a focus on “cheerleading” the company’s potential releases this year:

“Too much cheerleading; not enough ground-truth. In Q4, TSLA’s ASP weakness drive revenue, GPM, OPM, & EPS below consensus.”

As previously mentioned, Tesla did report weak financials that missed consensus estimates. What saved the call and perhaps the stock from plummeting on these missed metrics was the other details that Musk revealed, especially the FSD launch in Austin in June.

There were also plenty of things related to the affordable models and other vehicles, like the fact that Tesla plans to include things like Steer by Wire, Adaptive Air Suspension, and Rear Wheel Steering, that helped offset negatives.

Stein saw this as a distraction from what should have been reported:

“While CEO Elon Musk played the role of cheerleader, calling for TSLA’s path to massive market cap by leading in autonomy, management was remarkably short on two critical details: (1) info about new vehicles in 2025 and (2) milestones for AI acheivements, especially FSD. We continue to ask ourselves ‘where’s the beef?’ CY26 EPS to $3.99 (from $4.87). DCF-derived PT to $373 (from $351).”

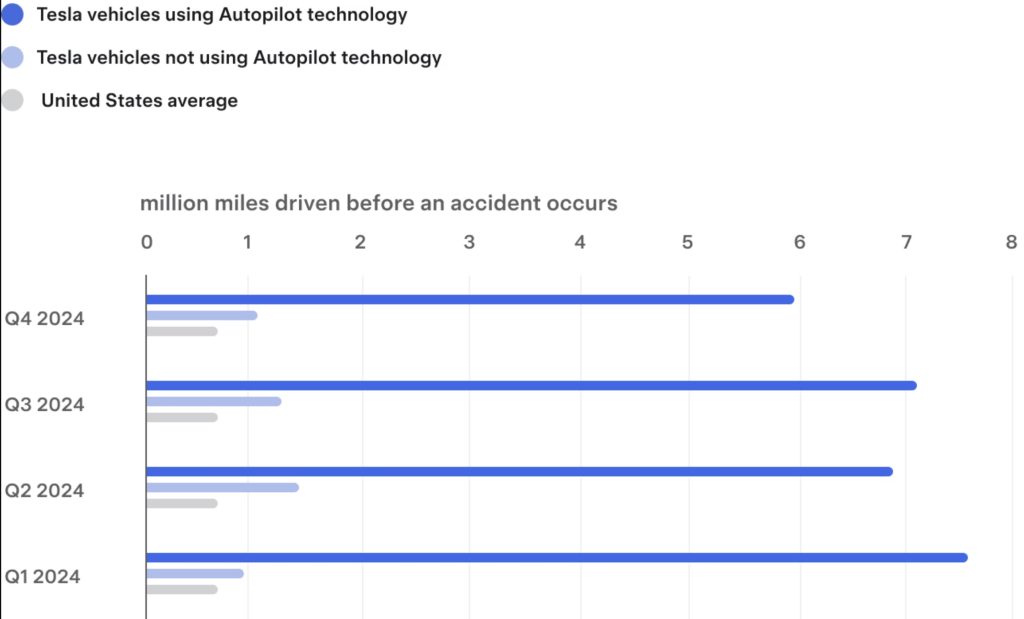

Tesla did detail some AI milestones, like its record-breaking miles per accident on Autopilot, which was a Q4-best of 5.94 million miles. The Shareholder Deck also outlined major upgrades to AI:

“In Q4, we completed the deployment of Cortex, a ~50k H100 training cluster at Gigafactory Texas. Cortex helped enable V13 of FSD (Supervised)1, which boasts major improvements in safety and comfort thanks to 4.2x increase in data, higher resolution video inputs, 2x reduction in photon-to-control latency and redesigned controller, among other enhancements.”

Tesla shares are up 2.11 percent on Thursday as of 12:05 p.m. on the East Coast.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla posts Q4 2024 vehicle safety report

Tesla has released its Q4 2024 vehicle safety report. Similar to data from previous quarters, vehicles that were operating with Autopilot technology proved notably safer.

The Q4 2024 report:

- As per Tesla, it recorded one crash for every 5.94 million miles driven in which drivers were using Autopilot technology.

- The company also recorded one crash for every 1.08 million miles driven for drivers who were not using Autopilot technology.

- For comparison, the most recent data available from the NHTSA and FHWA (from 2023) showed that there was one automobile crash every 702,000 miles in the United States.

Previous safety reports:

- In Q3 2024, Tesla recorded one crash for every 7.08 million miles driven in which drivers were using Autopilot technology and one crash for every 1.29 million miles driven by drivers not using Autopilot technology.

- In Q2 2024, Tesla recorded one crash for every 6.88 million miles driven in which drivers were using Autopilot technology, and one crash for every 1.45 million miles driven for drivers not using Autopilot technology.

- In Q1 2024, Tesla recorded one crash for every 7.63 million miles driven in which drivers were using Autopilot technology, and one crash for every 955,000 million miles driven for drivers not using Autopilot technology.

Year-over-Year Comparison:

- In Q4 2023, Tesla recorded one crash for every 5.39 million miles driven in which drivers were using Autopilot technology and one crash for every 1.00 million miles driven for drivers not using Autopilot technology.

Key background:

- Tesla began voluntarily releasing quarterly safety reports in October 2018 to provide critical safety information about our vehicles to the public.

- On July 2019, Tesla started voluntarily releasing annual updated data about vehicle fires as well.

- It should be noted that accident rates among all vehicles on the road can vary from quarter to quarter and can be affected by seasonality, such as reduced daylight and inclement weather conditions.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.