Investor's Corner

Tesla (TSLA) shares poised for a swing after Q1 earnings: Wall Street

Tesla’s (NASDAQ:TSLA) Q1 2021 earnings call is just a few hours away. After releasing a stellar production and delivery report, Wall Street analysts have high expectations for the first-quarter earnings call. Yet, some analysts remain cautious.

Options pricing suggests that TSLA stock may fluctuate 7.2% in either direction, a significant movement considering Tesla shares have seen less drastic swings in recent months. Based on a Bloomberg report, Wall Street analysts still believe that Tesla’s market share may dwindle as more legacy automakers produce electric vehicles of their own.

“We acknowledge Tesla has shaken up the auto industry, but recent commitments and advancements from incumbent automakers such as Volkswagen and General Motors suggest to us that Tesla has achieved peak market share within the EV category,” wrote Cowen analyst Jeffrey Osborne in a note earlier this month.

Indeed, consumers looking to purchase an electric vehicle have many more options in 2021 than in the previous year. And this year has brought on some serious competitors for popular Tesla vehicles like the Model Y, including the Ford Mustang Mach-E and the Volkswagen ID.4. In the summer, Rivian will take the stage with its R1T electric pickup truck.

However, Wall Street does acknowledge that Tesla still has a significant edge over incoming competitors, especially in terms of technology, software, and brand awareness. There is no denying that Tesla’s technology and software are at a level of their own. Also, the Tesla brand may be the most associated with battery electric vehicles.

Morgan Stanley’s Adam Jonas doesn’t deny Tesla’s leading position in the burgeoning EV market. “Tesla sees itself as the apex player during the most formative phase of the industrialization of sustainable propulsion and transition off of fossil fuels,” Jonas wrote in a note last week.

In a previous note, Morgan Stanley recognized Tesla’s disproportionate advantage over legacy automakers, noting that “auto investors face greater risk NOT OWNING Tesla shares in their portfolio” than owning TSLA stock.

Adam Jonas believes Tesla’s immediate priority is to expand capacity and begin “industrializing the Tesla hegemony before the [EV] market gets even more crowded.”

Wall Street analysts will likely ask about Giga Texas and Giga Berlin at the upcoming earnings call to see if Tesla can increase its production capacity. And as always, the question of demand will probably also arise.

Analysts from Loup Ventures observed that Tesla experienced 109% growth in the first quarter and is now entering the slope of its S-Curve growth. In January, the venture capital firm predicted that Tesla’s demand would accelerate this year and that Gigafactory Texas and Giga Berlin would be critical to meet demand.

Disclaimer: I am long TSLA.

The Teslarati team would appreciate hearing from you. If you have any tips, email us at tips@teslarati.com or reach out to me at maria@teslarati.com.

Investor's Corner

Tesla is ‘better-positioned’ as a company and as a stock as tariff situation escalates

Tesla is “better-positioned” as a company and as a stock as the tariff situation between the United States, Mexico, and Canada continues to escalate as President Donald Trump announced sanctions against those countries.

Analysts at Piper Sandler are unconcerned regarding Tesla’s position as a high-level stock holding as the tariff drama continues to unfold. This is mostly due to its reputation as a vehicle manufacturer in the domestic market, especially as it holds a distinct advantage of having some of the most American-made vehicles in the country.

Analysts at the firm, led by Alexander Potter, said Tesla is “one of the most defensive stocks” in the automotive sector as the tariff situation continues.

The defensive play comes from the nature of the stock, which should not be too impacted from a U.S. standpoint because of its focus on building vehicles and sourcing parts from manufacturers and companies based in the United States. Tesla has held the distinct title of having several of the most American-made cars, based on annual studies from Cars.com.

Its most recent study, released in June 2024, showed that the Model Y, Model S, and Model X are three of the top ten vehicles with the most U.S.-based manufacturing.

Tesla captures three spots in Cars.com’s American-Made Index, only U.S. manufacturer in list

The year prior, Tesla swept the top four spots of the study.

Piper Sandler analysts highlighted this point in a new note on Monday morning amidst increasing tension between the U.S. and Canada, as Mexico has already started to work with the Trump Administration on a solution:

“Tesla assembles five vehicles in the U.S., and all five rank among the most American-made cars.”

However, with that being said, there is certainly the potential for things to get tougher. The analysts believe that Tesla, while potentially impacted, will be in a better position than most companies because of their domestic position:

“If nothing changes in the next few days, tariffs will almost certainly deal a crippling blow to automotive supply chains in North America. [There is a possibility that] Trump capitulates in some way (perhaps he’ll delay implementation, in an effort to save face).”

There is no evidence that Tesla will be completely bulletproof when it comes to these potential impacts. However, it is definitely better insulated than other companies.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla gets price target boost from Truist, but it comes with criticism

Tesla (NASDAQ: TSLA) received a price target boost from analysts at Truist Securities, but it came with some criticisms based on a lack of information on several things that investors were excited to hear about regarding future vehicles and AI achievements.

Last night, Tesla reported its earnings from the fourth quarter of 2024, and while it had a very tempered financial showing, missing most of the Wall Street targets that were set for it, the stock was up after hours and on Thursday due to the details the company released regarding its plans for 2025.

CEO Elon Musk stunned listeners last night by revealing plans to launch unsupervised Full Self-Driving as a service in Austin in June 2025. It will be the first time Tesla will offer driverless FSD rides in public, something it has been working with the City of Austin on since December.

Tesla to launch unsupervised Full Self-Driving as a service in Austin in June

It also reiterated plans for affordable models to be launched this year, potentially catalyzing annual growth in deliveries, something it said it expects to resume in 2025.

Tesla was flat on deliveries in 2024 compared to 2023.

The positives during the call were enough for Truist Securities analyst William Stein to raise the company’s price target to $373 from $351. However, Stein’s note to investors showed there was something to be desired despite all the good that was revealed during the call:

Stein said there was “not enough ground-truth” during the call and too much of a focus on “cheerleading” the company’s potential releases this year:

“Too much cheerleading; not enough ground-truth. In Q4, TSLA’s ASP weakness drive revenue, GPM, OPM, & EPS below consensus.”

As previously mentioned, Tesla did report weak financials that missed consensus estimates. What saved the call and perhaps the stock from plummeting on these missed metrics was the other details that Musk revealed, especially the FSD launch in Austin in June.

There were also plenty of things related to the affordable models and other vehicles, like the fact that Tesla plans to include things like Steer by Wire, Adaptive Air Suspension, and Rear Wheel Steering, that helped offset negatives.

Stein saw this as a distraction from what should have been reported:

“While CEO Elon Musk played the role of cheerleader, calling for TSLA’s path to massive market cap by leading in autonomy, management was remarkably short on two critical details: (1) info about new vehicles in 2025 and (2) milestones for AI acheivements, especially FSD. We continue to ask ourselves ‘where’s the beef?’ CY26 EPS to $3.99 (from $4.87). DCF-derived PT to $373 (from $351).”

Tesla did detail some AI milestones, like its record-breaking miles per accident on Autopilot, which was a Q4-best of 5.94 million miles. The Shareholder Deck also outlined major upgrades to AI:

“In Q4, we completed the deployment of Cortex, a ~50k H100 training cluster at Gigafactory Texas. Cortex helped enable V13 of FSD (Supervised)1, which boasts major improvements in safety and comfort thanks to 4.2x increase in data, higher resolution video inputs, 2x reduction in photon-to-control latency and redesigned controller, among other enhancements.”

Tesla shares are up 2.11 percent on Thursday as of 12:05 p.m. on the East Coast.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla posts Q4 2024 vehicle safety report

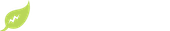

Tesla has released its Q4 2024 vehicle safety report. Similar to data from previous quarters, vehicles that were operating with Autopilot technology proved notably safer.

The Q4 2024 report:

- As per Tesla, it recorded one crash for every 5.94 million miles driven in which drivers were using Autopilot technology.

- The company also recorded one crash for every 1.08 million miles driven for drivers who were not using Autopilot technology.

- For comparison, the most recent data available from the NHTSA and FHWA (from 2023) showed that there was one automobile crash every 702,000 miles in the United States.

Previous safety reports:

- In Q3 2024, Tesla recorded one crash for every 7.08 million miles driven in which drivers were using Autopilot technology and one crash for every 1.29 million miles driven by drivers not using Autopilot technology.

- In Q2 2024, Tesla recorded one crash for every 6.88 million miles driven in which drivers were using Autopilot technology, and one crash for every 1.45 million miles driven for drivers not using Autopilot technology.

- In Q1 2024, Tesla recorded one crash for every 7.63 million miles driven in which drivers were using Autopilot technology, and one crash for every 955,000 million miles driven for drivers not using Autopilot technology.

Year-over-Year Comparison:

- In Q4 2023, Tesla recorded one crash for every 5.39 million miles driven in which drivers were using Autopilot technology and one crash for every 1.00 million miles driven for drivers not using Autopilot technology.

Key background:

- Tesla began voluntarily releasing quarterly safety reports in October 2018 to provide critical safety information about our vehicles to the public.

- On July 2019, Tesla started voluntarily releasing annual updated data about vehicle fires as well.

- It should be noted that accident rates among all vehicles on the road can vary from quarter to quarter and can be affected by seasonality, such as reduced daylight and inclement weather conditions.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.