Investor's Corner

Tesla remains volatile despite international Model 3 ramp, analysts’ optimistic outlook for 2019

Tesla stock (NASDAQ:TSLA) saw a steep, over 12% dive on Friday amidst news of a new round of layoffs and Elon Musk’s rather cautious tone about the company’s profitability in the fourth quarter and Q1 2019. As trading opened on Tuesday, TSLA stock seemed as volatile as ever, briefly showing some recovery after the opening bell before dipping into the red soon after.

In a way, the behavior of Tesla stock on Friday (and this Tuesday as of writing) was a bit strange. Not long after the company shared Elon Musk’s email explaining his reasons behind the 7% layoffs, after all, a number of Wall Street analysts covering the electric car maker expressed an optimistic view on Tesla, particularly as the company is now aiming to start breaching the international market with the Model 3, its most disruptive vehicle to date.

During a segment on CNBC’s Squawk Box, for one, Oppenheimer senior research analyst Colin Rusch, who has a $418 price target on the company, noted that Tesla’s recent job cuts were unsurprising and a likely sign of optimization.

“It’s not a huge surprise to see this. This looks to us like a mix of a proactive move in terms of cutting costs, … but also a bit of cleanup on the kind of massive push to get the Model 3 out this year. You never want to see a growth company cutting staff like this, but we’re not overly concerned,” Rusch said.

In a note to investors, Jefferies analyst Philippe Houchois, who has a $450 price target on TSLA, stated that the company’s reduced workforce suggests breakthroughs in productivity.

“Reducing headcount also suggests productivity gains. This is, in our view, (is) consistent with slower growth rates but mostly the scope to improve productivity and flow that we identified during our visit to the Fremont plant mid-November 2018,” the analyst said.

Baird analyst Ben Kallo, a longtime TSLA bull with a price target of $465 per share, noted that cost management would be crucial this 2019 as “Tesla transitions to its next phase of growth.” Wedbush analyst Dan Ives, who has a price target of $440 per share, stated that “Tesla will be able to emerge from the next 12 to 18 months” as an electric car maker that is stronger and more profitable.

Canaccord Genuity analyst Jed Dorsheimer, who has a $323 price target on TSLA, was more pronounced in his optimism for the company, stating that with the recent job cuts, “Tesla’s business is now set up for a more auspicious 2019.” Consumer Edge analyst Derek Glynn, who has a $350 price target on Tesla, noted that Elon Musk’s recent email suggested that “management is focused on achieving profitability each quarter after years of operating at significant losses.”

Former Tesla board member Steve Westly also took a similar stance, stating that the 7% job cuts are a sign that Elon Musk and Tesla’s management are taking the initiative to “right-size” the company and optimize it its more challenging, more ambitious future endeavors. This, according to Westly, gives the company a notable edge in the electric vehicle market.

“He is moving faster than anybody else, going global faster than anybody else, and today, Tesla is essentially the iPhone of the electric-car market. They’ve won the North American premium market race. The challenge now is to win the mass market, to go international. I think he is preparing the company to do that. I wouldn’t bet against him,” the former Tesla board member said.

That said, not everyone on Wall Street believes that Tesla’s recent job cuts bode well for the company. Citigroup analyst Itay Michaeli, who has a $284 price target on TSLA, mentioned in a note that the electric car maker’s lowered Q4 2018 guidance and 7% job cuts support the bear argument that the company’s stellar Q3 2018 results “weren’t sustainable.”

For now, Tesla is attempting to start deliveries of the Model 3 to two key international markets — Europe and China. Both territories present an important opportunity for the electric car maker, considering that Europe’s midsize sedan market is roughly twice as large as the United States.’ China’s electric car market, on the other hand, is the largest in the world. With Gigafactory 3 allowing Tesla to produce affordable variants of the Model 3 for the local market, the company’s electric sedan could prove to be a success in China.

As for Tesla’s upcoming competition this year, Oppenheimer analyst Colin Rusch notes that legacy automakers have some serious catching up to do.

“Let’s get realistic about what the competition looks like. I mean, people have been very excited about some of the vehicles coming out in 2018. One, those cars have been delayed. Two, the products haven’t been as exciting as people anticipated. We were just at the Detroit Auto Show this week, and we saw, you know, around ten EVs on the show floor, and none of them were particularly exciting,” the analyst said.

As of writing, Tesla stock is trading -1.04% at $299.12 per share.

Disclosure: I have no ownership in shares of TSLA and have no plans to initiate any positions within 72 hours.

Investor's Corner

Tesla is ‘better-positioned’ as a company and as a stock as tariff situation escalates

Tesla is “better-positioned” as a company and as a stock as the tariff situation between the United States, Mexico, and Canada continues to escalate as President Donald Trump announced sanctions against those countries.

Analysts at Piper Sandler are unconcerned regarding Tesla’s position as a high-level stock holding as the tariff drama continues to unfold. This is mostly due to its reputation as a vehicle manufacturer in the domestic market, especially as it holds a distinct advantage of having some of the most American-made vehicles in the country.

Analysts at the firm, led by Alexander Potter, said Tesla is “one of the most defensive stocks” in the automotive sector as the tariff situation continues.

The defensive play comes from the nature of the stock, which should not be too impacted from a U.S. standpoint because of its focus on building vehicles and sourcing parts from manufacturers and companies based in the United States. Tesla has held the distinct title of having several of the most American-made cars, based on annual studies from Cars.com.

Its most recent study, released in June 2024, showed that the Model Y, Model S, and Model X are three of the top ten vehicles with the most U.S.-based manufacturing.

Tesla captures three spots in Cars.com’s American-Made Index, only U.S. manufacturer in list

The year prior, Tesla swept the top four spots of the study.

Piper Sandler analysts highlighted this point in a new note on Monday morning amidst increasing tension between the U.S. and Canada, as Mexico has already started to work with the Trump Administration on a solution:

“Tesla assembles five vehicles in the U.S., and all five rank among the most American-made cars.”

However, with that being said, there is certainly the potential for things to get tougher. The analysts believe that Tesla, while potentially impacted, will be in a better position than most companies because of their domestic position:

“If nothing changes in the next few days, tariffs will almost certainly deal a crippling blow to automotive supply chains in North America. [There is a possibility that] Trump capitulates in some way (perhaps he’ll delay implementation, in an effort to save face).”

There is no evidence that Tesla will be completely bulletproof when it comes to these potential impacts. However, it is definitely better insulated than other companies.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla gets price target boost from Truist, but it comes with criticism

Tesla (NASDAQ: TSLA) received a price target boost from analysts at Truist Securities, but it came with some criticisms based on a lack of information on several things that investors were excited to hear about regarding future vehicles and AI achievements.

Last night, Tesla reported its earnings from the fourth quarter of 2024, and while it had a very tempered financial showing, missing most of the Wall Street targets that were set for it, the stock was up after hours and on Thursday due to the details the company released regarding its plans for 2025.

CEO Elon Musk stunned listeners last night by revealing plans to launch unsupervised Full Self-Driving as a service in Austin in June 2025. It will be the first time Tesla will offer driverless FSD rides in public, something it has been working with the City of Austin on since December.

Tesla to launch unsupervised Full Self-Driving as a service in Austin in June

It also reiterated plans for affordable models to be launched this year, potentially catalyzing annual growth in deliveries, something it said it expects to resume in 2025.

Tesla was flat on deliveries in 2024 compared to 2023.

The positives during the call were enough for Truist Securities analyst William Stein to raise the company’s price target to $373 from $351. However, Stein’s note to investors showed there was something to be desired despite all the good that was revealed during the call:

Stein said there was “not enough ground-truth” during the call and too much of a focus on “cheerleading” the company’s potential releases this year:

“Too much cheerleading; not enough ground-truth. In Q4, TSLA’s ASP weakness drive revenue, GPM, OPM, & EPS below consensus.”

As previously mentioned, Tesla did report weak financials that missed consensus estimates. What saved the call and perhaps the stock from plummeting on these missed metrics was the other details that Musk revealed, especially the FSD launch in Austin in June.

There were also plenty of things related to the affordable models and other vehicles, like the fact that Tesla plans to include things like Steer by Wire, Adaptive Air Suspension, and Rear Wheel Steering, that helped offset negatives.

Stein saw this as a distraction from what should have been reported:

“While CEO Elon Musk played the role of cheerleader, calling for TSLA’s path to massive market cap by leading in autonomy, management was remarkably short on two critical details: (1) info about new vehicles in 2025 and (2) milestones for AI acheivements, especially FSD. We continue to ask ourselves ‘where’s the beef?’ CY26 EPS to $3.99 (from $4.87). DCF-derived PT to $373 (from $351).”

Tesla did detail some AI milestones, like its record-breaking miles per accident on Autopilot, which was a Q4-best of 5.94 million miles. The Shareholder Deck also outlined major upgrades to AI:

“In Q4, we completed the deployment of Cortex, a ~50k H100 training cluster at Gigafactory Texas. Cortex helped enable V13 of FSD (Supervised)1, which boasts major improvements in safety and comfort thanks to 4.2x increase in data, higher resolution video inputs, 2x reduction in photon-to-control latency and redesigned controller, among other enhancements.”

Tesla shares are up 2.11 percent on Thursday as of 12:05 p.m. on the East Coast.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla posts Q4 2024 vehicle safety report

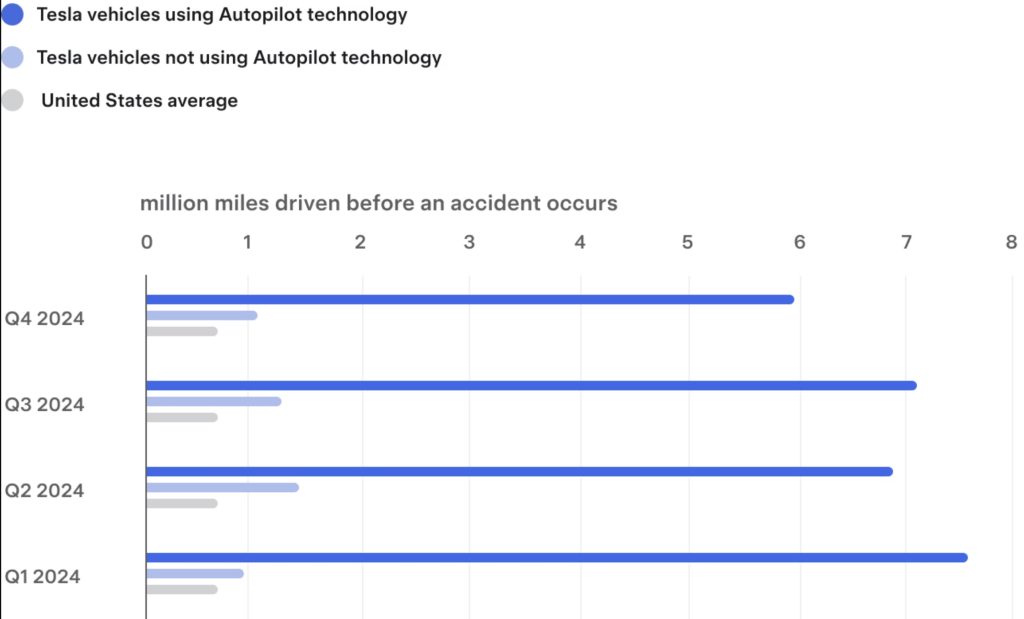

Tesla has released its Q4 2024 vehicle safety report. Similar to data from previous quarters, vehicles that were operating with Autopilot technology proved notably safer.

The Q4 2024 report:

- As per Tesla, it recorded one crash for every 5.94 million miles driven in which drivers were using Autopilot technology.

- The company also recorded one crash for every 1.08 million miles driven for drivers who were not using Autopilot technology.

- For comparison, the most recent data available from the NHTSA and FHWA (from 2023) showed that there was one automobile crash every 702,000 miles in the United States.

Previous safety reports:

- In Q3 2024, Tesla recorded one crash for every 7.08 million miles driven in which drivers were using Autopilot technology and one crash for every 1.29 million miles driven by drivers not using Autopilot technology.

- In Q2 2024, Tesla recorded one crash for every 6.88 million miles driven in which drivers were using Autopilot technology, and one crash for every 1.45 million miles driven for drivers not using Autopilot technology.

- In Q1 2024, Tesla recorded one crash for every 7.63 million miles driven in which drivers were using Autopilot technology, and one crash for every 955,000 million miles driven for drivers not using Autopilot technology.

Year-over-Year Comparison:

- In Q4 2023, Tesla recorded one crash for every 5.39 million miles driven in which drivers were using Autopilot technology and one crash for every 1.00 million miles driven for drivers not using Autopilot technology.

Key background:

- Tesla began voluntarily releasing quarterly safety reports in October 2018 to provide critical safety information about our vehicles to the public.

- On July 2019, Tesla started voluntarily releasing annual updated data about vehicle fires as well.

- It should be noted that accident rates among all vehicles on the road can vary from quarter to quarter and can be affected by seasonality, such as reduced daylight and inclement weather conditions.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.