As the automotive and energy sectors continue their aggressive pivot towards sustainable innovation, Tesla Inc. remains at the forefront of this transformation. The company's financial disclosures, particularly quarterly earnings releases, serve as critical benchmarks for investors, industry analysts, and environmental advocates alike. With the approaching release of Tesla's Q1 2025 earnings report, stakeholders are keenly analyzing not only the expected financial metrics but also the broader operational and strategic implications embedded within this pivotal disclosure. This case study examines Tesla's Q1 2025 earnings release date, recent trends, and the insights it is expected to offer, contextualizing its significance within Tesla's growth trajectory and the wider electrification movement.

Understanding Tesla’s Earnings Release Cycle and Its Strategic Significance

Tesla’s quarterly earnings releases constitute a cornerstone for assessing the company’s financial health, innovation pace, and market standing. Traditionally, Tesla’s reporting schedule aligns with standard fiscal year practices, releasing results roughly 30 days after each quarter concludes. For Q1 2025, which ends on March 31, 2025, investors are anticipating the earnings report around late April to early May. This notification window provides critical insights into Tesla’s operational performance during a period marked by technological advances, supply chain refinements, and burgeoning demand for EVs amid a competitive landscape.

The Evolution of Tesla’s Reporting Practices and Market Expectations

Since its initial IPO in 2010, Tesla’s quarterly disclosures have evolved from experimental disclosures to highly anticipated financial events that influence stock performance and investment strategies. The company’s focus on transparency is heightened by its unique position as both an automaker and a green energy enterprise, integrating revenue streams from vehicle sales, energy storage, and solar products.

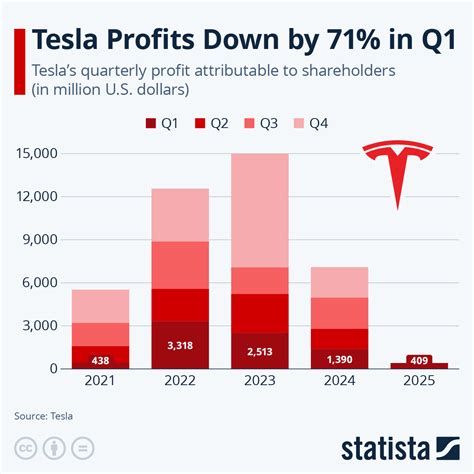

In recent years, Tesla has maintained an impressive record of beating earnings estimates, driven by gross margin enhancements and output increases. The Q4 2024 earnings, for example, demonstrated record vehicle deliveries and margin improvements, setting a high benchmark for Q1 2025. As Tesla navigates challenges such as global supply chain disruptions, regulatory shifts, and emerging competitor EV offerings, the upcoming earnings release is set to be scrutinized for operational resilience and strategic pivots.

| Relevant Category | Substantive Data |

|---|---|

| Expected Release Date | Between April 25 and May 10, 2025 |

| Historical Release Timing | Typically 30 days after quarter-end |

| Market Anticipation | High, driven by production milestones and margin expectations |

| Key Metrics Analyzed | Vehicle deliveries, gross margin, operating expenses, free cash flow |

Anticipated Key Insights from Tesla’s Q1 2025 Earnings Release

The upcoming financial report is expected to shed light on several critical areas that define Tesla’s future outlook. These include operational scalability, gross margin sustainability under rising raw material costs, regional demand patterns, and technological leadership in autonomous driving. Additionally, the performance of newly launched or expanded manufacturing facilities will be scrutinized for their contribution to quarterly output and profitability.

Operational Performance and Production Milestones

One of the primary metrics investors monitor is the number of vehicles produced and delivered within the quarter. For Q1 2025, Tesla is expected to report a record or near-record delivery figure, reflecting the company’s success in overcoming previous supply bottlenecks. The company’s new model variants, including the Cybertruck and revised Model 3/Y, are likely to contribute significantly to these figures.

Production expansion at the Berlin and Texas gigafactories is particularly pertinent. Any commentary on operational efficiencies, yield improvements, or bottlenecks at these facilities will inform stakeholders about Tesla’s capacity to meet growing demand while maintaining quality standards.

Financial Metrics and Profitability

Gross margin, a key profitability indicator, has historically been a strength for Tesla, often outperforming traditional automakers even amid macroeconomic headwinds. The Q1 2025 report is expected to reinforce this trend, with analysts predicting margins of approximately 20–22%. The detailed breakdown of cost controls, supply chain management, and pricing strategies will provide a nuanced view of Tesla’s profitability sustainability.

Furthermore, the company’s operating expenses, R&D investments, and net income will be critical components in assessing whether Tesla can fund its aggressive growth plans without sacrificing financial health.

| Relevant Category | Substantive Data |

|---|---|

| Vehicle Deliveries | Expected 420,000–430,000 units in Q1 2025 |

| Gross Margin | Projected at 20–22% |

| Revenue | Anticipated $25–27 billion |

| Net Income | Estimated at $2.5–3 billion |

Strategic Outlook and Forward-Looking Statements

Beyond the raw numbers, Tesla’s earnings call and shareholder letter often provide strategic updates that forecast future performance. For Q1 2025, key themes are expected to include advancements in autonomous driving technology, expansion into emerging markets, and progress toward sustainable energy solutions.

Autonomous Vehicles and Regulatory Landscape

One of Tesla’s most watched topics is the development and deployment of its full self-driving (FSD) and autonomy suite. Enhancements in AI algorithms, safety validation, and regulatory approvals will directly influence the company’s revenue from autonomous taxi services and FSD packages. The earnings report might include updates on regulatory hurdles or recent pilot programs, all of which hold substantial implications for Tesla’s business model evolution.

Global Market Expansion and Localization

Entering new geographical markets continues to be a cornerstone of Tesla’s growth. Countries like India and Southeast Asia are on the horizon for expanded sales, contingent upon regulatory clearances and infrastructure development. Tesla’s international strategy execution will be briefly summarized, with potential impacts on sales volume and revenue diversification.

| Relevant Category | Substantive Data |

|---|---|

| Autonomy Update | Expected advancements and regulatory progress announced during earnings call |

| International Expansion | Plans and milestones for entering new markets, including local partnerships or factory developments |

| Sustainability Initiatives | Progress on battery recycling, energy storage deployments, and Solar initiatives |

Expected Timeline for Tesla’s Q1 2025 Earnings Release and Subsequent Events

The typical timeline for Tesla’s quarterly earnings follows a well-established pattern, but recent shifts in reporting practices suggest a cautious approach. Historically, Tesla has announced its Q1 results approximately 28 to 35 days after the quarter-end, often accompanied by an investor conference call and supplementary disclosures.

Given the typical window, the scheduled release for Q1 2025 will likely fall between late April and early May 2025. The company’s investor relations team tends to issue a formal press release followed by a live webcast, where Elon Musk and other executives will provide insights into quarterly performance, outlook, and strategic initiatives.

Upcoming key events include:

- Q1 2025 earnings announcement (tentative date: April 29, 2025)

- Q1 earnings webcast and Q&A session

- Release of supplementary investor presentation and detailed financial tables

- Potential updates on FSD regulatory approval and new product launches

- Follow-up analyst calls and media coverage analyzing performance and strategic outlook

Implications for Investors and Market Dynamics

Timely access to Tesla’s earnings data allows investors to recalibrate risk assessments and growth expectations. An earnings beat can propel Tesla’s stock to new highs, while a miss may trigger short-term volatility. Additionally, the tone of Tesla’s forward-looking statements influences broader market sentiment, especially regarding EV technological leadership and supply chain resilience amid geopolitical tensions and raw material shortages.

When is Tesla’s Q1 2025 earnings release expected?

+Based on historical patterns, Tesla’s Q1 2025 earnings release is anticipated between April 25 and May 10, 2025. The company usually announces earnings approximately 30 days after quarter-end.

What are the key factors to watch in Tesla’s upcoming earnings?

+Investors should focus on vehicle delivery volumes, gross margin stability, progress on gigafactory expansions, autonomous driving developments, and updates on international market entries.

How might Tesla’s earnings impact its stock performance?

+Positive earnings and optimistic future guidance can drive stock appreciation, while any signs of operational challenges or margin pressures may cause short-term declines. The market’s reaction will also hinge on the tone of Tesla’s strategic outlooks and regulatory updates.