News

Tesla, SpaceX, Elon Musk ventures cleared by SEC for private fundraising after tweet controversy

Tesla, SpaceX, The Boring Company (TBC), and Neuralink have all been granted waivers allowing them to continue raising capital by privately selling restricted securities (typically private equity or debt), heading off potential barriers that would increase the difficulty of raising capital through the sale of securities.

Cued by the commission’s settled suit over CEO Elon Musk’s improper and misleading dissemination of information material to Tesla shareholders, the United States Securities and Exchange Commission (SEC) has granted investment disqualification waivers – specifically “waivers of disqualification under Rule 506 of Regulation D” – to each of the four major companies owned by Elon Musk.

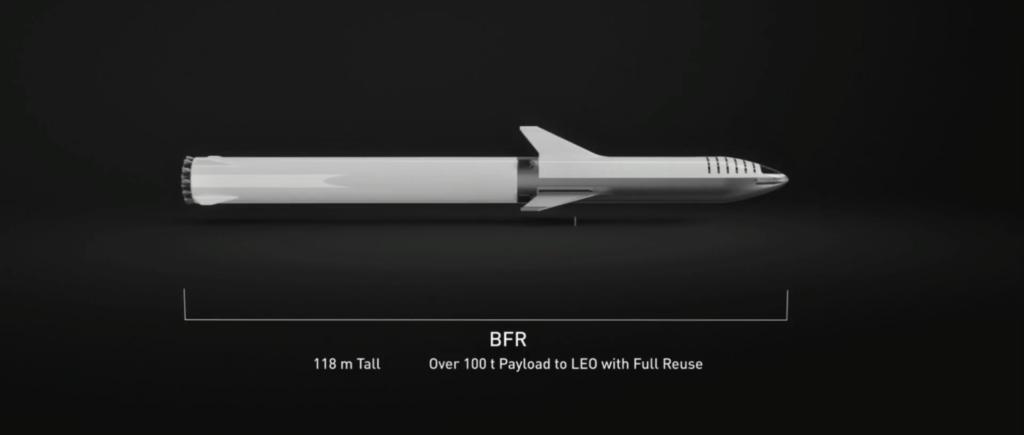

- Building giant factories like Gigafactory 2 demands major capital investments that often require private equity sales. (Tesla)

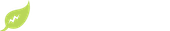

- Rockets are perhaps even more capital intensive. (SpaceX)

Losing the ability to raise funds in this manner would make it much harder for companies like Tesla and SpaceX to raise the money frequently needed for expansions and major R&D projects, described in the waiver requests as “extremely capital intensive.” However, the bulk of the arguments provided by each company’s legal representatives can be largely ignored. Arguing to the contrary – i.e. failing to make a strong case that the given company may need private equity investment – could close critical doors that each company may not need right this moment but would like to preserve as an option.

Still, each waiver request offers a slight glimpse into the inner-workings of SpaceX, TBC, and Neuralink, typically hidden from the public eye as privately held entities.

Tesla

Tesla, being a publicly-traded company, offered few secrets in its waiver request. However, it did publicize the best overview yet of what exactly the SEC’s demand for the regulation of Elon Musk’s Tesla-material communications might translate to inside the company. According to Tesla’s legal representatives, the company is arranging the creation of “new, permanent committee…of independent directors only [that] will provide an additional check on the procedures and processes for overseeing Mr. Musk’s Tesla-related public statements.” Tesla will also reportedly task “another experienced securities lawyer…to undertake an enhanced review of communications made through Twitter and other social media by the [sic] Tesla’s senior officers.”

The hope is that this new arrangement will prevent a recurrence of the misconduct that led to the SEC’s suit and the subsequent settlement. More likely, however, is that the threat of the modification or withdrawal of these four waivers will prevent Musk from stepping outside the bounds of the SEC’s binding settlement agreement, as doing so could truly harm the potential of all four companies.

SpaceX

In SpaceX’s waiver request, the company’s legal representatives confirmed that it has raised “more than $2 billion in [eleven separate] securities offerings” that fell under the purview of activities SpaceX would be disqualified from pursuing without a waiver from the SEC. The total value of investments on the public record currently hovers around $2.27 billion, including a partially-finished Series I round that has likely raised that to value to ~$2.5 billion since it surfaced in April 2018.

“The design and manufacture of launch vehicles and spacecraft is extremely capital intensive. SpaceX needs sufficient [and may need to raise additional] capital to fund its ongoing operations and future expansions, for example: development of its BFR launch vehicle and Crew Dragon spacecraft, continuing research and development projects, and making investments in tooling and manufacturing”

The Boring Company & Neuralink

As for TBC and Neuralink, the waivers didn’t offer anything unexpected, although they did provide great, brief overviews of what exactly the two companies are currently working towards. Although it was announced in late 2017 that Musk would sell stock to fund initial operations at TBC and Neuralink, both companies’ legal representatives confirmed the exact amount of funding raised by “Musk and various other third-party investors”: $112.5 million and $100.2 million, respectively.

Both expressly confirmed no intentions to pursue initial public offerings (IPOs) anytime soon, although Neuralink’s waiver indicated that it may invest in or acquire other companies pursuing brain-computer interfaces.

- Musk believes that TBC will finish its first test-tunnel in roughly six weeks, in early December. (TBC)

- The Boring Company’s next-gen tunnel-boring machine seen in its early stages, October 5th. [Credit: Tom Cross/Teslarati]

- While we have no clue what Neuralink’s stealthed work has produced, it’s perhaps the most long-term venture Musk has started. The path to market for medical devices is very long and even more expensive.

The Boring Company

“The Boring Company (TBC) is a fast-growing infrastructure and transportation company focused on developing cost effective, and fast tunneling technology, along with electric mass transportation systems to alleviate the massive problem of traffic and congestion within cities. The research, development, design, manufacture, testing, and construction of tunnels and mass transit systems is a capital intensive business. TBC needs sufficient capital to fund its ongoing operations and future expansions, for example: continued development and improvement of Tunnel Boring Machines (“TBMs”) and electric skates, the construction of mass transit tunnels including publicly announced projects in Chicago, Los Angeles, and Washington D.C..”

Neuralink

“Neuralink is a fast-growing bio-technology and medical device company focused on developing high bandwidth, long term, brain computer interfaces (“BCI”). The research, development, design, manufacture, testing, and certification of medical devices and BCI’s is purely capital intensive business requiting deep investment for years prior to any initial revenue. Neuralink needs sufficient capital to fund its ongoing operations and eventually bringing products to marked, for example: continued development of BCI’s, continued testing of implantable devices, financing of multi-year FDA trials and certifications, and the construction of FDA-approved manufacturing facilities. Neuralink will need to raise capital for these operations and expansions, and given the development stage of the company, it is most likely that such financing will be through private securities offerings in reliance on Rule 506 of Regulation D.”

News

Armored Tesla Cybertruck “War Machine” debuts at Defense Expo 2025

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Temporibus autem quibusdam et aut officiis debitis aut rerum necessitatibus saepe eveniet ut et voluptates repudiandae sint et molestiae non recusandae. Itaque earum rerum hic tenetur a sapiente delectus, ut aut reiciendis voluptatibus maiores alias consequatur aut perferendis doloribus asperiores repellat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

“Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat”

Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed quia consequuntur magni dolores eos qui ratione voluptatem sequi nesciunt.

Et harum quidem rerum facilis est et expedita distinctio. Nam libero tempore, cum soluta nobis est eligendi optio cumque nihil impedit quo minus id quod maxime placeat facere possimus, omnis voluptas assumenda est, omnis dolor repellendus.

Nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem. Ut enim ad minima veniam, quis nostrum exercitationem ullam corporis suscipit laboriosam, nisi ut aliquid ex ea commodi consequatur.

At vero eos et accusamus et iusto odio dignissimos ducimus qui blanditiis praesentium voluptatum deleniti atque corrupti quos dolores et quas molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia deserunt mollitia animi, id est laborum et dolorum fuga.

Quis autem vel eum iure reprehenderit qui in ea voluptate velit esse quam nihil molestiae consequatur, vel illum qui dolorem eum fugiat quo voluptas nulla pariatur.

News

Tesla Megapacks chosen for 548 MWh energy storage project in Japan

Tesla plans to supply over 100 Megapack units to support a large stationary storage project in Japan, making it one of the country’s largest energy storage facilities.

Tesla’s Megapack grid-scale batteries have been selected to back an energy storage project in Japan, coming as the latest of the company’s continued deployment of the hardware.

As detailed in a report from Nikkei this week, Tesla plans to supply 142 Megapack units to support a 548 MWh storage project in Japan, set to become one of the country’s largest energy storage facilities. The project is being overseen by financial firm Orix, and it will be located at a facility Maibara in central Japan’s Shiga prefecture, and it aims to come online in early 2027.

The deal is just the latest of several Megapack deployments over the past few years, as the company continues to ramp production of the units. Tesla currently produces the Megapack at a facility in Lathrop, California, though the company also recently completed construction on its second so-called “Megafactory” in Shanghai China and is expected to begin production in the coming weeks.

READ MORE ON TESLA MEGAPACKS: Tesla Megapacks help power battery supplier Panasonic’s Kyoto test site

Tesla’s production of the Megapack has been ramping up at the Lathrop facility since initially opening in 2022, and both this site and the Shanghai Megafactory are aiming to eventually reach a volume production of 10,000 Megapack units per year. The company surpassed its 10,000th Megapack unit produced at Lathrop in November.

During Tesla’s Q4 earnings call last week, CEO Elon Musk also said that the company is looking to construct a third Megafactory, though he did not disclose where.

Last year, Tesla Energy also had record deployments of its Megapack and Powerwall home batteries with a total of 31.4 GWh of energy products deployed for a 114-percent increase from 2023.

Other recently deployed or announced Megapack projects include a massive 600 MW/1,600 MWh facility in Melbourne, a 75 MW/300 MWh energy storage site in Belgium, and a 228 MW/912 MWh storage project in Chile, along with many others still.

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send us tips at tips@teslarati.com.

Tesla highlights the Megapack site replacing Hawaii’s last coal plant

Need accessories for your Tesla? Check out the Teslarati Marketplace:

News

Elon Musk responds to Ontario canceling $100M Starlink deal amid tariff drama

Ontario Premier Doug Ford said, opens new tab on February 3 that he was “ripping up” his province’s CA$100 million agreement with Starlink in response to the U.S. imposing tariffs on Canadian goods.

Elon Musk company SpaceX is set to lose a $100 million deal with the Canadian province of Ontario following a response to the Trump administration’s decision to apply 25 percent tariffs to the country.

Starlink, a satellite-based internet service launched by the Musk entity SpaceX, will lose a $100 million deal it had with Ontario, Premier Doug Ford announced today.

Starting today and until U.S. tariffs are removed, Ontario is banning American companies from provincial contracts.

Every year, the Ontario government and its agencies spend $30 billion on procurement, alongside our $200 billion plan to build Ontario. U.S.-based businesses will…

— Doug Ford (@fordnation) February 3, 2025

Ford said on X today that Ontario is banning American companies from provincial contracts:

“We’ll be ripping up the province’s contract with Starlink. Ontario won’t do business with people hellbent on destroying our economy. Canada didn’t start this fight with the U.S., but you better believe we’re ready to win it.”

It is a blow to the citizens of the province more than anything, as the Starlink internet constellation has provided people in rural areas across the globe stable and reliable access for several years.

Musk responded in simple terms, stating, “Oh well.”

Oh well https://t.co/1jpMu55T6s

— Elon Musk (@elonmusk) February 3, 2025

It seems Musk is less than enthused about the fact that Starlink is being eliminated from the province, but it does not seem like all that big of a blow either.

As previously mentioned, this impacts citizens more than Starlink itself, which has established itself as a main player in reliable internet access. Starlink has signed several contracts with various airlines and maritime companies.

It is also expanding to new territories across the globe on an almost daily basis.

With Mexico already working to avoid the tariff situation with the United States, it will be interesting to see if Canada does the same.

The two have shared a pleasant relationship, but President Trump is putting his foot down in terms of what comes across the border, which could impact Americans in the short term.