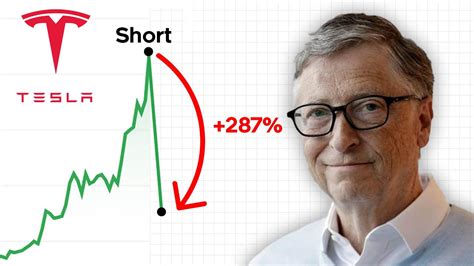

Tesla, Inc., the pioneering electric vehicle (EV) and clean energy company, has been a focal point of intense speculation and volatility in the financial markets. As one of the most successful and recognizable brands in the world, Tesla's stock has been subject to extreme price fluctuations, making it a popular target for short sellers. Shorting Tesla stock options is a complex and high-risk strategy that requires a deep understanding of the underlying market dynamics, options trading, and the company's fundamentals. In this article, we will delve into the world of shorting Tesla stock options, exploring the key concepts, risks, and considerations involved in this sophisticated investment approach.

Understanding Short Selling and Options Trading

Short selling involves selling a security that the seller does not own, with the expectation of buying it back at a lower price to realize a profit. In the context of options trading, shorting Tesla stock options means selling call or put options to buyers, who are hoping to profit from potential price movements in the underlying stock. Call options give the buyer the right to buy Tesla stock at a specified price (strike price), while put options give the buyer the right to sell Tesla stock at the strike price. By selling options, the short seller is obligated to buy or sell the underlying stock at the strike price if the option is exercised.

Types of Options and Trading Strategies

There are two primary types of options: American and European. American options can be exercised at any time before expiration, while European options can only be exercised on the expiration date. Short sellers can employ various trading strategies, including covered calls, naked calls, and spreads. A covered call involves selling call options while owning the underlying stock, whereas a naked call involves selling call options without owning the stock. Spreads involve buying and selling options with different strike prices or expiration dates to profit from price differences.

| Option Type | Strike Price | Expiration Date |

|---|---|---|

| Call Option | $500 | March 17, 2023 |

| Put Option | $400 | June 15, 2023 |

Risks and Considerations

Shorting Tesla stock options is a high-risk strategy that can result in significant losses if not managed properly. The main risks involved include unlimited potential losses, assignment risk, and time decay. Unlimited potential losses occur when the underlying stock price rises significantly, and the short seller is forced to buy the stock at a much higher price to cover their position. Assignment risk arises when the option is exercised, and the short seller is obligated to buy or sell the underlying stock at the strike price. Time decay refers to the erosion of the option’s value over time, which can reduce the potential profit for the short seller.

Managing Risk and Position Sizing

To mitigate these risks, short sellers must employ effective risk management strategies, such as position sizing, stop-loss orders, and diversification. Position sizing involves allocating a specific amount of capital to each trade, while stop-loss orders can help limit potential losses by automatically closing the position when the stock price reaches a certain level. Diversification involves spreading investments across different asset classes and sectors to reduce exposure to any one particular stock or market.

Key Points

- Shorting Tesla stock options involves selling call or put options to buyers, with the expectation of buying the underlying stock at a lower price.

- Understanding options trading, including types of options and trading strategies, is crucial for success.

- Risks involved in shorting Tesla stock options include unlimited potential losses, assignment risk, and time decay.

- Effective risk management strategies, such as position sizing, stop-loss orders, and diversification, can help mitigate these risks.

- A thorough analysis of the stock's technical and fundamental indicators is essential for making informed decisions.

In conclusion, shorting Tesla stock options is a complex and high-risk strategy that requires a deep understanding of the underlying market dynamics, options trading, and the company's fundamentals. By employing effective risk management strategies and staying informed about market conditions, investors can navigate the challenges and opportunities involved in shorting Tesla stock options. However, it's essential to approach this strategy with caution and carefully consider the potential risks and consequences.

What is the main risk involved in shorting Tesla stock options?

+The main risk involved in shorting Tesla stock options is unlimited potential losses, which can occur when the underlying stock price rises significantly, and the short seller is forced to buy the stock at a much higher price to cover their position.

How can short sellers mitigate the risks involved in shorting Tesla stock options?

+Short sellers can mitigate the risks involved in shorting Tesla stock options by employing effective risk management strategies, such as position sizing, stop-loss orders, and diversification.

What is the importance of understanding options trading in shorting Tesla stock options?

+Understanding options trading, including types of options and trading strategies, is crucial for success in shorting Tesla stock options. It helps investors make informed decisions and navigate the complexities of the options market.

Meta Description: Learn about the risks and considerations involved in shorting Tesla stock options, and discover how to navigate the complexities of the options market with effective risk management strategies. (149 characters)