Investor's Corner

Elon Musk makes a rare appearance on SolarCity’s Q2 conference call

SolarCity reported its Q2 quarterly results on Tuesday August 9, 2016, but unlike calls from the past where CEO Lyndon Rive’s provides a financial outlook for the nation’s largest full-service solar provider, Tesla CEO and SolarCity Chairman Elon Musk took stage to discuss future plans for the company. This marks a rare occasion for Musk and arrives at a time when discussions for the impending merger between Tesla and SolarCity is the hot topic among shareholders and analysts.

SolarCity provided shareholders with a Q2 2016 Shareholder Letter and accompanying Slide Presentation. While there might be little interest in the earnings report for Tesla owners and fans, quite a few interesting tidbits were provided during the afternoon SolarCity Analysts conference call by Musk.

Tesla Acquisition

Philip Lee-Wei Shen of ROTH Capital Partners asked why “the final deal and offer price was actually lower than the original price.”

Elon responded that “this is a negotiation of the independent board members. I actually wasn’t part of – and part of it was simply what they came up after, I think, a quite exhaustive discussion that lasted a week or two. So I’ve not inquired about the details and I’m not privy to the details, but it was ultimately what they concluded was fair between the independent board members of SolarCity and the board members of Tesla. Obviously, this is now up to the shareholder votes, independent shareholder votes where, I would say, I’m recusing myself. I’m not legally obligated to recuse myself, I’m just doing so, because I think it’s morally the right thing to do and so is Lyndon and Pete and JB Straubel.”

A new Product: Solar Roof

SolarCity is going to enter the “solar roof” market.

“We’re going to be making a pretty interesting product and I’m excited to kind of reveal to you all at some point, but it is not just your typical module, it is both very efficient and it looks really, really good,” said Peter Rive (CTO).

Elon elaborated that “It’s a solar roof as opposed to a module on a roof. I think, this is really a fundamental part of achieving a differentiated product strategy – it’s not a beautiful roof, that it is a solar roof, it’s not a thing on a roof, it is the roof. That’s – which is quite a difficult engineering challenge, and not something that is available really anywhere else that is at all good. I think this will be something that’s quite a standout. So one of the things I’m really very excited about the future.”

“It’s just addressing a really big market segment, so just in the U.S., there is 5 million new roofs installed every year,” said Lyndon Rive (CEO).

“The interesting thing about this is that it actually doesn’t cannibalize the existing product of putting solar on roof, because essentially if your roof is nearing end-of-life, you definitely don’t want to put solar panels on it, because you’re going to have to replace the roof,” said Elon Musk (Chairman). “So, there is a huge market segment that is currently inaccessible to SolarCity, because people know they’re going to have to replace their roof, you don’t want to put solar panels on top of a roof you’re going to replace. However, if you are close – if your roof is nearing end-of-life, well, you’ve got to get a new roof anyway, there’s 5 million new roofs a year just in the U.S. And so, why not have a solar roof that’s better in many others ways as well. We don’t want to show all of our cards right now, but I think people are going to be really excited about what they see.”

Notice that roof solar is a business where there are players already: Luma Resources, CertainTeed and Integrated Solar Technology, in particular and one that DOW Chemical just exited.

The solar roof product will be manufactured in Buffalo, NY. Elon added that “it’s really important to manufacturing in-house because its panels control the aesthetics and ideally really design – it’s kind of like making a custom car, like when somebody orders a car from Tesla, they’ll pick a wide array of options, that car will be custom made to their preferences, and you really want the roof custom-made to the individual customer as a kit and then sent to, that will be, the delivery team to get installed.”

Home Energy Management

Colin Rusch of Oppenheimer inquired “how long is it going to be before the combined entity [Tesla Motors + SolarCity] introduces a home energy management system or some sort of robust energy efficiency offering?”

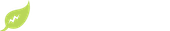

To which Elon joked that “solar and battery go together like peanut butter and jelly. You obviously need the battery, particularly as you get to scale and you want to have solar be a bigger and bigger percentage of the grid. If you don’t have the batteries there to balance the grid and buffer the power, you really can’t go beyond a certain percentage of solar in a particular neighborhood. Maybe you can go up to about 20% solar, but more than that, it starts to unbalance the grid and you need to buffer it, because the energy generation is low at dawn and dusk, it’s high in middle of the day, and it’s at zero during at night. So you got to smooth that out.”

Elon reiterated the usual “sustainable energy” mantra he has been preaching for a decade: “if you like sort of fast forward to where do we want the world eventually to be is want the world to have a sustainable energy generation, a sustainable energy consumption, so that it really requires the three critical ingredients for that, there is the solar panels, the stationary batteries, and electric vehicles.”

Who is going to Win? Rooftop or centralized generation?

“You’ll have millions of these batteries, you’ve got to manage that and integrate it with the utility,” said Elon. “I do want to emphasize, there’s still a very important role for utilities here, sometimes people think that this is an either/or thing, it’s like either rooftops are going to win or centralized generation is going to win and actually both are going to win, because the electricity usage is going to increase dramatically as we transition away from burning old dinosaurs to electric cars, and then to electric transport, we would see roughly a doubling of electricity consumption as all transport moves to electric. And then, there is a tripling of electricity usage if you take all heating and make that electric as well, because obviously most heating is from oil and natural gas particularly.”

Combining battery and rooftop solar

Gordon Johnson of Axiom Capital Management inquired what was the rationale behind the acquisition [of SolarCity by Tesla] when “combining a battery and a rooftop solar company didn’t make a ton of sense because when you have a rooftop solar company with net metering, the grid acts as, effectively, a battery, ruling out the need for a battery technology.”

“Where we see net metering evolving over the next few years, I think this is a really important part of how storage is a combination with the solar,” answered Peter Rive (CTO). “A case that I’d like everybody to review is what just recently happened in New York. This is a collaboration of the local utilities and the solar industry. And the collaboration is net metering for the next three years and then a phasing to more of a grid services model, where you combine solar, storage, smart inverters and provide all these additional grid services, and you phase that in and then essentially you phase-out net metering into that grid services model.”

Peter concluded that “we see that probably happening as a standard policy and we’re going to promote that across all the different states. But you – we have to get to a point where it is the grid services, so that, actually it recognizes the value that solar and storage can provide you to grid.”

I think Peter Rive indeed sees the writing on the wall for “net metering” as being phased out over time. Net metering has disappeared already from states like Nevada, and while it has been retained in California, at least until 2019, all local utilities are switching gradually to TOD (Time-of-Day) billing (the “grid services” model Peter references above), where a “smart battery storage” product that provides “time-shifting” will solve the solar basic dilemma: while solar production peaks during midday, energy consumption is highest in the morning and evening. With storage, you can save the energy you produce for when you need it most, and at the same time you limit the output to the grid, a benefit to the local utility.

Investor's Corner

Tesla is ‘better-positioned’ as a company and as a stock as tariff situation escalates

Tesla is “better-positioned” as a company and as a stock as the tariff situation between the United States, Mexico, and Canada continues to escalate as President Donald Trump announced sanctions against those countries.

Analysts at Piper Sandler are unconcerned regarding Tesla’s position as a high-level stock holding as the tariff drama continues to unfold. This is mostly due to its reputation as a vehicle manufacturer in the domestic market, especially as it holds a distinct advantage of having some of the most American-made vehicles in the country.

Analysts at the firm, led by Alexander Potter, said Tesla is “one of the most defensive stocks” in the automotive sector as the tariff situation continues.

The defensive play comes from the nature of the stock, which should not be too impacted from a U.S. standpoint because of its focus on building vehicles and sourcing parts from manufacturers and companies based in the United States. Tesla has held the distinct title of having several of the most American-made cars, based on annual studies from Cars.com.

Its most recent study, released in June 2024, showed that the Model Y, Model S, and Model X are three of the top ten vehicles with the most U.S.-based manufacturing.

Tesla captures three spots in Cars.com’s American-Made Index, only U.S. manufacturer in list

The year prior, Tesla swept the top four spots of the study.

Piper Sandler analysts highlighted this point in a new note on Monday morning amidst increasing tension between the U.S. and Canada, as Mexico has already started to work with the Trump Administration on a solution:

“Tesla assembles five vehicles in the U.S., and all five rank among the most American-made cars.”

However, with that being said, there is certainly the potential for things to get tougher. The analysts believe that Tesla, while potentially impacted, will be in a better position than most companies because of their domestic position:

“If nothing changes in the next few days, tariffs will almost certainly deal a crippling blow to automotive supply chains in North America. [There is a possibility that] Trump capitulates in some way (perhaps he’ll delay implementation, in an effort to save face).”

There is no evidence that Tesla will be completely bulletproof when it comes to these potential impacts. However, it is definitely better insulated than other companies.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla gets price target boost from Truist, but it comes with criticism

Tesla (NASDAQ: TSLA) received a price target boost from analysts at Truist Securities, but it came with some criticisms based on a lack of information on several things that investors were excited to hear about regarding future vehicles and AI achievements.

Last night, Tesla reported its earnings from the fourth quarter of 2024, and while it had a very tempered financial showing, missing most of the Wall Street targets that were set for it, the stock was up after hours and on Thursday due to the details the company released regarding its plans for 2025.

CEO Elon Musk stunned listeners last night by revealing plans to launch unsupervised Full Self-Driving as a service in Austin in June 2025. It will be the first time Tesla will offer driverless FSD rides in public, something it has been working with the City of Austin on since December.

Tesla to launch unsupervised Full Self-Driving as a service in Austin in June

It also reiterated plans for affordable models to be launched this year, potentially catalyzing annual growth in deliveries, something it said it expects to resume in 2025.

Tesla was flat on deliveries in 2024 compared to 2023.

The positives during the call were enough for Truist Securities analyst William Stein to raise the company’s price target to $373 from $351. However, Stein’s note to investors showed there was something to be desired despite all the good that was revealed during the call:

Stein said there was “not enough ground-truth” during the call and too much of a focus on “cheerleading” the company’s potential releases this year:

“Too much cheerleading; not enough ground-truth. In Q4, TSLA’s ASP weakness drive revenue, GPM, OPM, & EPS below consensus.”

As previously mentioned, Tesla did report weak financials that missed consensus estimates. What saved the call and perhaps the stock from plummeting on these missed metrics was the other details that Musk revealed, especially the FSD launch in Austin in June.

There were also plenty of things related to the affordable models and other vehicles, like the fact that Tesla plans to include things like Steer by Wire, Adaptive Air Suspension, and Rear Wheel Steering, that helped offset negatives.

Stein saw this as a distraction from what should have been reported:

“While CEO Elon Musk played the role of cheerleader, calling for TSLA’s path to massive market cap by leading in autonomy, management was remarkably short on two critical details: (1) info about new vehicles in 2025 and (2) milestones for AI acheivements, especially FSD. We continue to ask ourselves ‘where’s the beef?’ CY26 EPS to $3.99 (from $4.87). DCF-derived PT to $373 (from $351).”

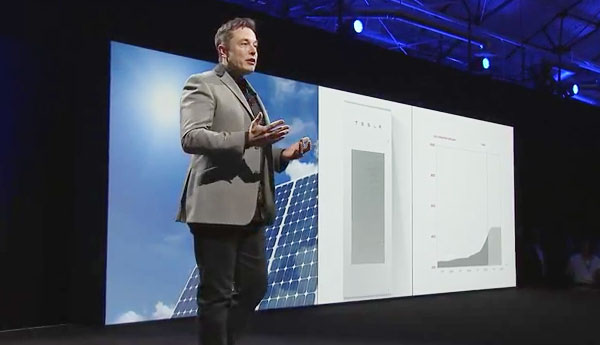

Tesla did detail some AI milestones, like its record-breaking miles per accident on Autopilot, which was a Q4-best of 5.94 million miles. The Shareholder Deck also outlined major upgrades to AI:

“In Q4, we completed the deployment of Cortex, a ~50k H100 training cluster at Gigafactory Texas. Cortex helped enable V13 of FSD (Supervised)1, which boasts major improvements in safety and comfort thanks to 4.2x increase in data, higher resolution video inputs, 2x reduction in photon-to-control latency and redesigned controller, among other enhancements.”

Tesla shares are up 2.11 percent on Thursday as of 12:05 p.m. on the East Coast.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla posts Q4 2024 vehicle safety report

Tesla has released its Q4 2024 vehicle safety report. Similar to data from previous quarters, vehicles that were operating with Autopilot technology proved notably safer.

The Q4 2024 report:

- As per Tesla, it recorded one crash for every 5.94 million miles driven in which drivers were using Autopilot technology.

- The company also recorded one crash for every 1.08 million miles driven for drivers who were not using Autopilot technology.

- For comparison, the most recent data available from the NHTSA and FHWA (from 2023) showed that there was one automobile crash every 702,000 miles in the United States.

Previous safety reports:

- In Q3 2024, Tesla recorded one crash for every 7.08 million miles driven in which drivers were using Autopilot technology and one crash for every 1.29 million miles driven by drivers not using Autopilot technology.

- In Q2 2024, Tesla recorded one crash for every 6.88 million miles driven in which drivers were using Autopilot technology, and one crash for every 1.45 million miles driven for drivers not using Autopilot technology.

- In Q1 2024, Tesla recorded one crash for every 7.63 million miles driven in which drivers were using Autopilot technology, and one crash for every 955,000 million miles driven for drivers not using Autopilot technology.

Year-over-Year Comparison:

- In Q4 2023, Tesla recorded one crash for every 5.39 million miles driven in which drivers were using Autopilot technology and one crash for every 1.00 million miles driven for drivers not using Autopilot technology.

Key background:

- Tesla began voluntarily releasing quarterly safety reports in October 2018 to provide critical safety information about our vehicles to the public.

- On July 2019, Tesla started voluntarily releasing annual updated data about vehicle fires as well.

- It should be noted that accident rates among all vehicles on the road can vary from quarter to quarter and can be affected by seasonality, such as reduced daylight and inclement weather conditions.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.