Cerebro capital, a term coined by investors and financial analysts, refers to the cognitive abilities and mental frameworks that enable individuals to make informed, strategic investment decisions. In today's fast-paced and complex financial landscape, unlocking cerebro capital has become a crucial factor in achieving success. By understanding the psychological and neurological aspects of decision-making, investors can develop smarter investment strategies that yield better returns. This article will explore the concept of cerebro capital, its key components, and provide actionable insights on how to unlock it.

The importance of cerebro capital cannot be overstated. Research has shown that cognitive biases and emotional influences can significantly impact investment decisions, often leading to suboptimal outcomes. By developing a deeper understanding of these factors, investors can learn to navigate complex markets with greater confidence and precision. Furthermore, the ability to adapt to changing market conditions and learn from past experiences is essential for long-term success.

Understanding Cerebro Capital

Cerebro capital encompasses a range of cognitive abilities, including critical thinking, problem-solving, and decision-making. It also involves emotional intelligence, risk management, and the ability to learn from experience. Investors with high cerebro capital are able to analyze complex information, identify patterns, and make informed decisions quickly. They are also able to manage their emotions and avoid common cognitive biases that can lead to poor investment choices.

One of the key components of cerebro capital is mental flexibility, the ability to adapt to changing market conditions and adjust investment strategies accordingly. This involves being open to new information, considering alternative perspectives, and being willing to pivot when necessary. Another essential aspect of cerebro capital is emotional regulation, the ability to manage emotions and avoid impulsive decisions.

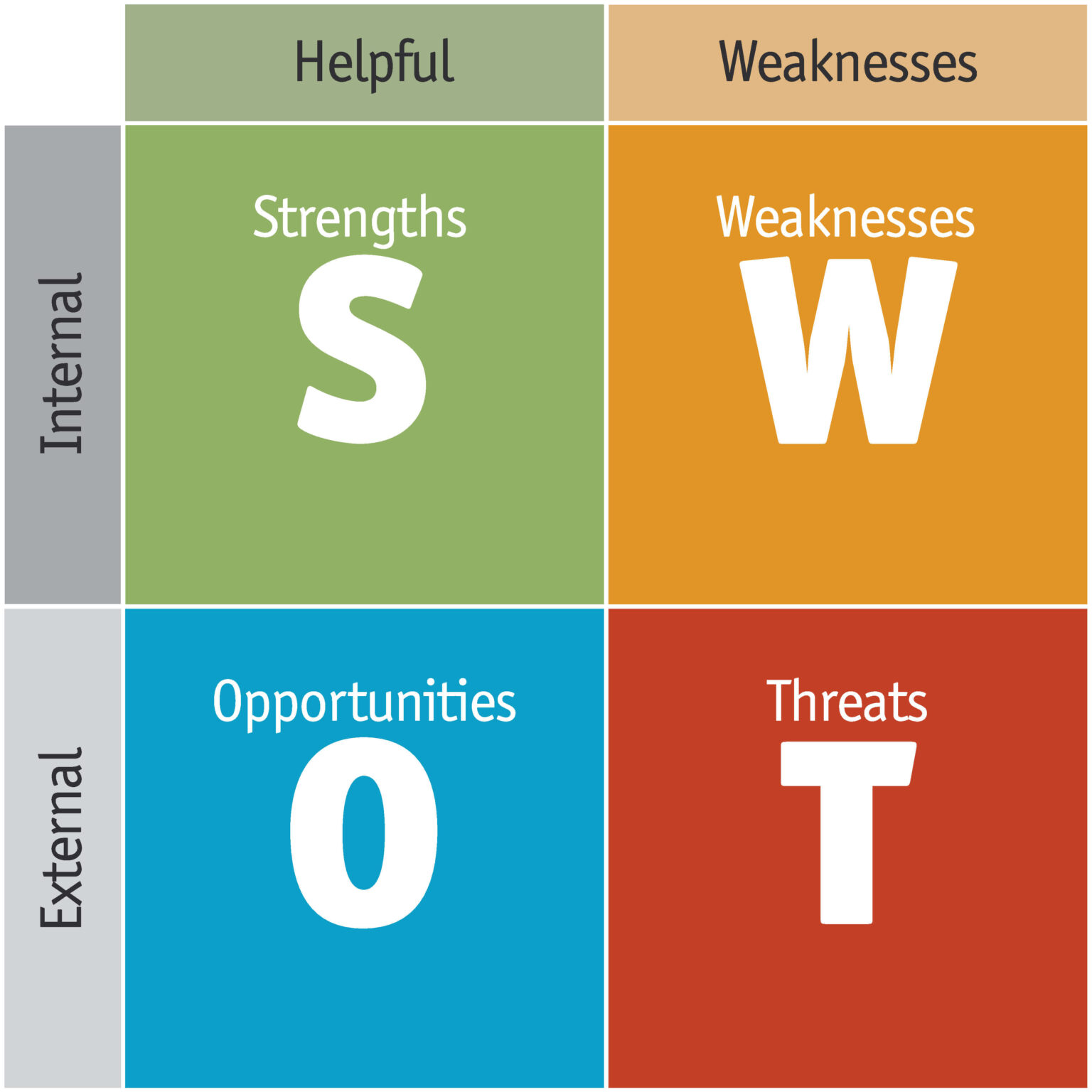

The Role of Cognitive Biases in Investment Decisions

Cognitive biases are systematic errors in thinking that can influence investment decisions. Common biases include confirmation bias, anchoring bias, and loss aversion. These biases can lead to suboptimal investment choices and decreased returns. For example, confirmation bias can cause investors to seek out information that confirms their existing views, rather than considering alternative perspectives.

| Cognitive Bias | Description |

|---|---|

| Confirmation Bias | The tendency to seek out information that confirms existing views |

| Anchoring Bias | The tendency to rely too heavily on the first piece of information encountered |

| Loss Aversion | The tendency to prefer avoiding losses over acquiring gains |

Developing Cerebro Capital

Developing cerebro capital requires a combination of education, experience, and self-awareness. Investors can improve their cognitive abilities by learning about investing, practicing critical thinking, and developing emotional intelligence. This can involve reading books and articles, attending seminars and workshops, and seeking out mentors or coaches.

Another key aspect of developing cerebro capital is self-reflection, the ability to examine one's own thought processes and biases. This involves being aware of one's emotions and motivations, and taking steps to manage them. By developing greater self-awareness, investors can make more informed decisions and avoid common cognitive biases.

Practical Strategies for Unlocking Cerebro Capital

So, how can investors unlock their cerebro capital and develop smarter investment strategies? Here are a few practical strategies:

- Practice mindfulness: Mindfulness can help investors develop greater self-awareness and manage their emotions.

- Seek out diverse perspectives: Exposing oneself to different viewpoints and opinions can help investors identify biases and consider alternative scenarios.

- Develop a long-term perspective: Focusing on long-term goals can help investors avoid impulsive decisions and stay focused on their investment strategy.

Key Points

- Cerebro capital refers to the cognitive abilities and mental frameworks that enable informed investment decisions.

- Cognitive biases and emotional influences can significantly impact investment decisions.

- Developing cerebro capital requires education, experience, and self-awareness.

- Practical strategies for unlocking cerebro capital include mindfulness, seeking out diverse perspectives, and developing a long-term perspective.

- Investors with high cerebro capital are able to recognize and manage cognitive biases, making more informed investment decisions.

Conclusion

Unlocking cerebro capital is essential for achieving success in today's complex financial landscape. By understanding the psychological and neurological aspects of decision-making, investors can develop smarter investment strategies that yield better returns. By practicing mindfulness, seeking out diverse perspectives, and developing a long-term perspective, investors can unlock their cerebro capital and make more informed investment decisions.

What is cerebro capital?

+Cerebro capital refers to the cognitive abilities and mental frameworks that enable individuals to make informed, strategic investment decisions.

Why is cerebro capital important?

+Cerebro capital is essential for achieving success in today’s complex financial landscape. It enables investors to make informed decisions, navigate complex markets, and adapt to changing conditions.

How can I develop cerebro capital?

+Developing cerebro capital requires a combination of education, experience, and self-awareness. Investors can improve their cognitive abilities by learning about investing, practicing critical thinking, and developing emotional intelligence.