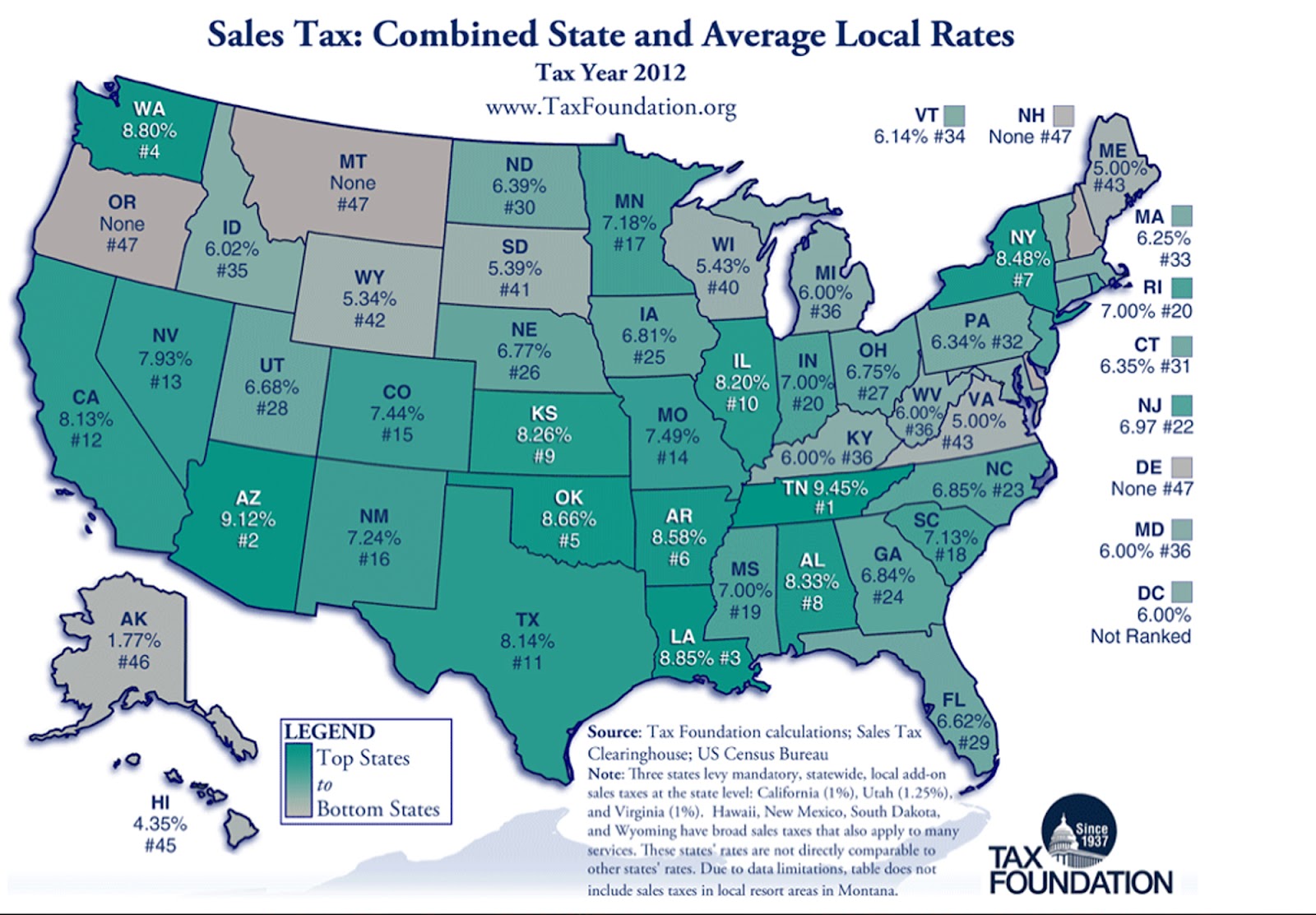

Arizona, known for its desert landscapes and vibrant cities, is a popular destination for both tourists and businesses. When it comes to sales tax, Arizona has a unique system that can be complex for outsiders to navigate. In this article, we will delve into the intricacies of Arizona sales tax, exploring its rates, exemptions, and implications for businesses and consumers alike.

Overview of Arizona Sales Tax

Arizona imposes a transaction privilege tax (TPT) on the sale of tangible personal property and certain services. The TPT is a combination of state, county, and city taxes, with rates varying depending on the location of the sale. As of 2023, the state TPT rate is 5.6%, with additional rates applied by counties and cities. For instance, the city of Phoenix imposes a 2.3% tax, while the city of Tucson imposes a 2.1% tax. Understanding these rates is crucial for businesses to accurately calculate and remit the correct amount of tax.

Key Points

- The state TPT rate in Arizona is 5.6%, with additional rates applied by counties and cities.

- Businesses must obtain a TPT license from the Arizona Department of Revenue to collect and remit sales tax.

- Certain goods and services are exempt from sales tax, including food for home consumption and prescription medications.

- Arizona allows local jurisdictions to impose their own sales tax rates, resulting in varying rates across the state.

- Out-of-state sellers may be required to collect and remit Arizona sales tax if they have a substantial presence in the state.

Transactional Privilege Tax (TPT) Rates

The TPT rate in Arizona consists of the state rate and additional rates imposed by counties and cities. The state rate is 5.6%, while county and city rates range from 0.1% to 3.5%. For example, the total TPT rate in Phoenix is 8.6% (5.6% state rate + 2.3% city rate + 0.7% county rate), while the total TPT rate in Tucson is 8.1% (5.6% state rate + 2.1% city rate + 0.4% county rate). These rates are subject to change, and businesses must stay up-to-date to ensure compliance.

| Location | TPT Rate |

|---|---|

| State of Arizona | 5.6% |

| City of Phoenix | 2.3% |

| City of Tucson | 2.1% |

| Pima County | 0.7% |

| Maricopa County | 0.7% |

Exemptions and Deductions

Certain goods and services are exempt from Arizona sales tax, including food for home consumption, prescription medications, and medical equipment. Additionally, some businesses may be eligible for deductions, such as the deduction for bad debts. It’s crucial for businesses to understand these exemptions and deductions to avoid overpaying sales tax and to ensure compliance with state regulations.

Exempt Goods and Services

Arizona exempts certain goods and services from sales tax, including:

- Food for home consumption

- Prescription medications

- Medical equipment

- Religious and charitable organizations

- Certain agricultural products

These exemptions can help reduce the tax burden on businesses and consumers, but it's essential to understand the specific requirements and limitations of each exemption to ensure compliance.

Implications for Businesses and Consumers

The Arizona sales tax system has significant implications for businesses and consumers. Businesses must obtain a TPT license, collect and remit sales tax, and understand the various rates and exemptions. Consumers, on the other hand, must be aware of the sales tax rates in their area and the exemptions available to them. Failure to comply with sales tax regulations can result in penalties and fines, emphasizing the need for ongoing education and consultation with tax professionals.

What is the state TPT rate in Arizona?

+The state TPT rate in Arizona is 5.6%.

Are there any exemptions from Arizona sales tax?

+Yes, certain goods and services are exempt from Arizona sales tax, including food for home consumption, prescription medications, and medical equipment.

Do out-of-state sellers need to collect and remit Arizona sales tax?

+Out-of-state sellers may be required to collect and remit Arizona sales tax if they have a substantial presence in the state.

In conclusion, the Arizona sales tax system is complex and requires ongoing education and consultation with tax professionals to ensure compliance. By understanding the TPT rates, exemptions, and implications for businesses and consumers, individuals can navigate the system with confidence and avoid potential penalties and fines.