Investor's Corner

Tesla short-seller explains losses, reduced position after TSLA’s rise in late October

Jan Petter Sissener is not a careless investor. Being one of short-sellers betting against Tesla stock (NASDAQ:TSLA), the Norwegian businessman and hedge fund manager has been rewarded in the past due to dips in the electric car maker’s stock. During the third quarter, though, things did not go according to plan, and Sissener Canopus, the fund that Sissener manages, saw its worst loss in two years.

Sissener’s losses on October were almost a stroke of irony. The short-seller noted to Norwegian newspaper Dagens Næringsliv that he actually took a very careful stance at the beginning of the month, even adjusting his fund’s share weight to about 50%. Despite this, Sissener Canopus still fell 5.5%. In a report to his clients, Sissener admitted that one of the main reasons behind the fund’s losses was Tesla, which saw a steep rise at the end of October, fueled by the company’s surprisingly strong third-quarter earnings. Sissener’s bets in two other companies, Transocean and Elkem, did not pan out as well.

Sissener noted to the Norwegian publication that he does not understand Tesla’s third-quarter figures, and that he is presently trying to investigate the company’s numbers. While the fund manager stated that he is not ruling out an increased short position against the company in the near future, Sissener noted that he had reduced his short position on Tesla nonetheless.

“October became a painful month for world stock markets, and although we were very careful and had a lot of indexes, some of our key positions dropped significantly more than the markets. We had timed the market right, but lost on single shares. We have done two things (on Tesla). Firstly, we took a little profit when the stock reached $ 250. Then we weighed a little after the quarterly figures came,” he said.

As Tesla’s short-sellers begin to feel some pressure, some of the company’s supporters are expressing optimistic forecasts for the electric car maker. In a recent interview with CNBC, for example, billionaire investor Ron Baron reiterated his statement that Tesla might be a $1 trillion company by 2030. When asked if he has any reservations about Tesla’s capability to become consistently cash-flow positive, Baron stated that he remains confident in the company and Elon Musk.

“As far as the cash flow goes, when I look at the numbers, it doesn’t appear to be a problem. Elon Musk says it’s not a problem. I take him at his word. And he could have sold equity a year and a half ago at $370, $380 a share, people scrambling to buy, he chose not to. You have these businesses that they invest, and when they’re investing, they penalize profitability. (They’re) at the point now where incremental investments are going to be profitable. They are now doing 5,000 cars a week. They’re gonna be able to do for Model 3, for virtually no additional investment, they’re gonna get to 7,000 cars a week,” Baron said.

Wall Street analyst Maynard Um of Macquarie Research also adopted an optimistic stance on Tesla for the coming quarters. In a note last Thursday, the analyst stated that the company “checks all the boxes” except for one to be included in the S&P 500. While it remains to be seen if Tesla can stay profitable, Um nevertheless stated that a steady demand for the Model S and X, as well as improving production numbers of the Model 3, could allow the electric car maker to be eligible for the S&P 500, possibly sometime next year.

“While (Tesla) still has to prove it can sustain profitability, we believe the company will achieve this last eligibility requirement driven by steady demand for Model S & X, increasing production to meet Model 3 demand, and potential for meaningful (Zero Emission Vehicle) credit revenue,” the analyst wrote.

There is no doubt that Tesla’s third-quarter results were a pleasant surprise for the company’s investors. That said, Tesla’s current strategies, such as the introduction of the Mid Range Model 3, VIN filings at record batches, and Panasonic’s additional battery cell production lines in Gigafactory 1, suggest that Q4 might be even better. In an extensive interview with tech journalist Kara Swisher during the Recode Decode podcast, Elon Musk even noted that Tesla is actually capable of producing 6,000-6,500 Model 3 per week now, though such a feat would require a lot of overtime from the company’s workers.

“We’re certainly over the hump on Model 3 production. For us, making 5,000 cars in a week for Model 3 is not a big deal. That’s just normal. Now we’re working on raising to 6,000 and then 7,000 Model 3s a week, while still keeping costs under control. We could probably do 6,000 or more, maybe 6,500 Model 3s a week right now, but it would have to stress people out and do tons of overtime,” Musk said.

As of writing, Tesla stock is trading at -1.14% at $346.50 per share.

Watch billionaire investor Ron Baron’s take on Tesla’s in the video below.

Disclosure: I have no ownership in shares of TSLA and have no plans to initiate any positions within 72 hours.

Investor's Corner

Tesla is ‘better-positioned’ as a company and as a stock as tariff situation escalates

Tesla is “better-positioned” as a company and as a stock as the tariff situation between the United States, Mexico, and Canada continues to escalate as President Donald Trump announced sanctions against those countries.

Analysts at Piper Sandler are unconcerned regarding Tesla’s position as a high-level stock holding as the tariff drama continues to unfold. This is mostly due to its reputation as a vehicle manufacturer in the domestic market, especially as it holds a distinct advantage of having some of the most American-made vehicles in the country.

Analysts at the firm, led by Alexander Potter, said Tesla is “one of the most defensive stocks” in the automotive sector as the tariff situation continues.

The defensive play comes from the nature of the stock, which should not be too impacted from a U.S. standpoint because of its focus on building vehicles and sourcing parts from manufacturers and companies based in the United States. Tesla has held the distinct title of having several of the most American-made cars, based on annual studies from Cars.com.

Its most recent study, released in June 2024, showed that the Model Y, Model S, and Model X are three of the top ten vehicles with the most U.S.-based manufacturing.

Tesla captures three spots in Cars.com’s American-Made Index, only U.S. manufacturer in list

The year prior, Tesla swept the top four spots of the study.

Piper Sandler analysts highlighted this point in a new note on Monday morning amidst increasing tension between the U.S. and Canada, as Mexico has already started to work with the Trump Administration on a solution:

“Tesla assembles five vehicles in the U.S., and all five rank among the most American-made cars.”

However, with that being said, there is certainly the potential for things to get tougher. The analysts believe that Tesla, while potentially impacted, will be in a better position than most companies because of their domestic position:

“If nothing changes in the next few days, tariffs will almost certainly deal a crippling blow to automotive supply chains in North America. [There is a possibility that] Trump capitulates in some way (perhaps he’ll delay implementation, in an effort to save face).”

There is no evidence that Tesla will be completely bulletproof when it comes to these potential impacts. However, it is definitely better insulated than other companies.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla gets price target boost from Truist, but it comes with criticism

Tesla (NASDAQ: TSLA) received a price target boost from analysts at Truist Securities, but it came with some criticisms based on a lack of information on several things that investors were excited to hear about regarding future vehicles and AI achievements.

Last night, Tesla reported its earnings from the fourth quarter of 2024, and while it had a very tempered financial showing, missing most of the Wall Street targets that were set for it, the stock was up after hours and on Thursday due to the details the company released regarding its plans for 2025.

CEO Elon Musk stunned listeners last night by revealing plans to launch unsupervised Full Self-Driving as a service in Austin in June 2025. It will be the first time Tesla will offer driverless FSD rides in public, something it has been working with the City of Austin on since December.

Tesla to launch unsupervised Full Self-Driving as a service in Austin in June

It also reiterated plans for affordable models to be launched this year, potentially catalyzing annual growth in deliveries, something it said it expects to resume in 2025.

Tesla was flat on deliveries in 2024 compared to 2023.

The positives during the call were enough for Truist Securities analyst William Stein to raise the company’s price target to $373 from $351. However, Stein’s note to investors showed there was something to be desired despite all the good that was revealed during the call:

Stein said there was “not enough ground-truth” during the call and too much of a focus on “cheerleading” the company’s potential releases this year:

“Too much cheerleading; not enough ground-truth. In Q4, TSLA’s ASP weakness drive revenue, GPM, OPM, & EPS below consensus.”

As previously mentioned, Tesla did report weak financials that missed consensus estimates. What saved the call and perhaps the stock from plummeting on these missed metrics was the other details that Musk revealed, especially the FSD launch in Austin in June.

There were also plenty of things related to the affordable models and other vehicles, like the fact that Tesla plans to include things like Steer by Wire, Adaptive Air Suspension, and Rear Wheel Steering, that helped offset negatives.

Stein saw this as a distraction from what should have been reported:

“While CEO Elon Musk played the role of cheerleader, calling for TSLA’s path to massive market cap by leading in autonomy, management was remarkably short on two critical details: (1) info about new vehicles in 2025 and (2) milestones for AI acheivements, especially FSD. We continue to ask ourselves ‘where’s the beef?’ CY26 EPS to $3.99 (from $4.87). DCF-derived PT to $373 (from $351).”

Tesla did detail some AI milestones, like its record-breaking miles per accident on Autopilot, which was a Q4-best of 5.94 million miles. The Shareholder Deck also outlined major upgrades to AI:

“In Q4, we completed the deployment of Cortex, a ~50k H100 training cluster at Gigafactory Texas. Cortex helped enable V13 of FSD (Supervised)1, which boasts major improvements in safety and comfort thanks to 4.2x increase in data, higher resolution video inputs, 2x reduction in photon-to-control latency and redesigned controller, among other enhancements.”

Tesla shares are up 2.11 percent on Thursday as of 12:05 p.m. on the East Coast.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla posts Q4 2024 vehicle safety report

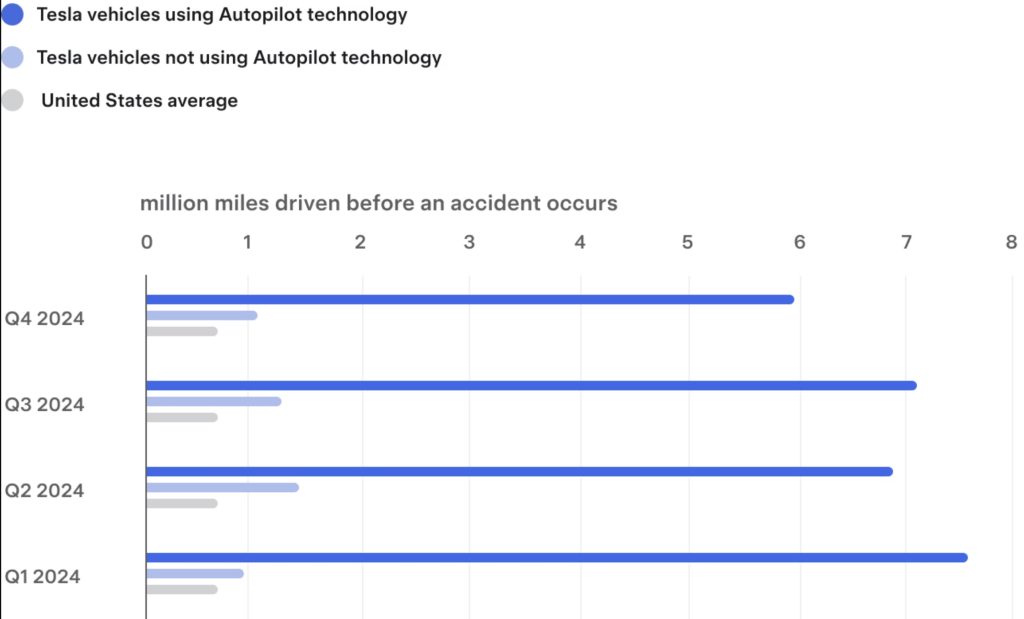

Tesla has released its Q4 2024 vehicle safety report. Similar to data from previous quarters, vehicles that were operating with Autopilot technology proved notably safer.

The Q4 2024 report:

- As per Tesla, it recorded one crash for every 5.94 million miles driven in which drivers were using Autopilot technology.

- The company also recorded one crash for every 1.08 million miles driven for drivers who were not using Autopilot technology.

- For comparison, the most recent data available from the NHTSA and FHWA (from 2023) showed that there was one automobile crash every 702,000 miles in the United States.

Previous safety reports:

- In Q3 2024, Tesla recorded one crash for every 7.08 million miles driven in which drivers were using Autopilot technology and one crash for every 1.29 million miles driven by drivers not using Autopilot technology.

- In Q2 2024, Tesla recorded one crash for every 6.88 million miles driven in which drivers were using Autopilot technology, and one crash for every 1.45 million miles driven for drivers not using Autopilot technology.

- In Q1 2024, Tesla recorded one crash for every 7.63 million miles driven in which drivers were using Autopilot technology, and one crash for every 955,000 million miles driven for drivers not using Autopilot technology.

Year-over-Year Comparison:

- In Q4 2023, Tesla recorded one crash for every 5.39 million miles driven in which drivers were using Autopilot technology and one crash for every 1.00 million miles driven for drivers not using Autopilot technology.

Key background:

- Tesla began voluntarily releasing quarterly safety reports in October 2018 to provide critical safety information about our vehicles to the public.

- On July 2019, Tesla started voluntarily releasing annual updated data about vehicle fires as well.

- It should be noted that accident rates among all vehicles on the road can vary from quarter to quarter and can be affected by seasonality, such as reduced daylight and inclement weather conditions.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.