News

Tesla on the winning end of proposed U.S. import tax

U.S. automobile sales might slow as a result of the proposed import tax affecting vehicles with manufacturers outside of the country. However, this change could stimulate up to 1 million additional vehicles could be manufactured in the U.S., which would add 50,000 more jobs at car production and part assembly plants.

That good news/ bad news scenario is according to researchers at Baum & Associates, LLC, which advises suppliers. Their report is intended to provide estimates to show the relative impact of the tax plan on each automaker. Dan Luria, an economist at the Michigan Manufacturing Technology Center in Ann Arbor, is the lead author of the Baum & Associates report, which accounts for imports of both finished vehicles and parts for domestic cars that are made overseas.

According to a report by Bloomberg, Tesla is the single automaker that would be able to maintain consistent pricing before and after such a tax implementation, as it manufactures all its cars in the U.S. and incorporates predominately U.S. made parts.

Border tax consequences for automakers

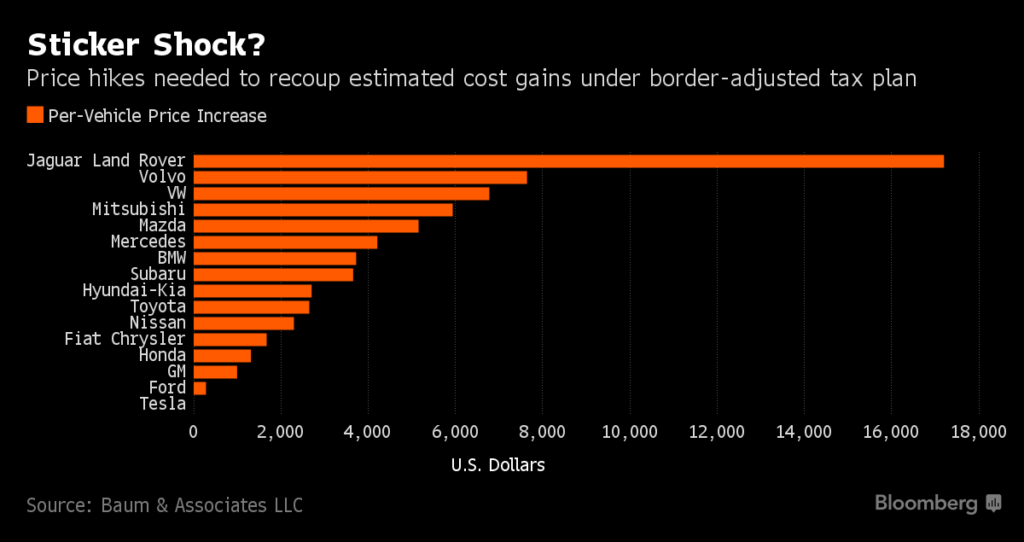

According to Baum & Associates, LLC, most automakers would need to raise vehicle prices by thousands of dollars. They would also likely have to assume a portion of the higher tax burden.

- Ford, with significant domestic manufacturing, would accrue the smallest price hike among major automakers, at about $282 per vehicle;

- General Motors Co. would experience a $995 increase per vehicle;

- Volvo and VW vehicle prices would have to rise by about $7,600 and $6,800, on average;

- Jaguar’s Land Rover, which is 100% imported, would require an increase of more than $17,000 per vehicle.

According to Alan Baum, the founder of the West Bloomfield, Michigan-based firm which produced the report, “The plan results in a net cost for automakers. Each company will then make its own decisions on pricing in order to best compete and maximize its profits.”

In what direction might a proposed border tax shift automakers’ current business practices? Essentially, the tax would create an incentive for automakers to keep U.S. plants running at the expense of those in Canada and Mexico. It could also steer auto companies currently conducting business in the U.S. to other markets.

- Automakers may boost U.S. parts procurement and production from existing vehicle assembly plants;

- Overseas automakers including Fuji Heavy Industries Ltd.’s Subaru, Mitsubishi Motors Corp., Mazda Motor Corp., Hyundai Motor Co., and Kia Motors Corp. may consider expanding existing U.S. operations or building new capacity;

- Volkswagen AG could build another U.S. assembly plant;

- Fiat Chrysler Automobiles NV may accelerate the conversion of factories in Michigan to build pickups there instead of Mexico;

- Nissan Motor Co. might export more from Mexico to Latin American markets and less to the U.S.;

- Mazda and Mitsubishi, which rely entirely on imports to the U.S. market, may have to quit the U.S. market or pay other manufacturers to assemble their cars.

Meanwhile, Toyota Motor Corp. is one of the corporations that is warning that the proposed border tax will result in many costlier products, not only in automobiles, but also in food, clothing, and gasoline, among other areas.

Other analysts weigh in on the effects of a proposed border tax

It’s not just Baum and associates who are advising clients on their prospective bottom lines should a border tax become legislated by U.S. officials. Other analysts are weighing in on the proposed border tax effects on commerce. Colin Langan, an analyst at UBS Securities LLC, argues that the proposed border tax could raise average prices in the U.S. by about 8 percent, or $2,500 per vehicle.

The border tax has the potential to reduce annual sales by about 2 million vehicles, Langan said.

He also projects that, while the tax has the potential to move through the House of Representatives, it is “very unlikely” to pass in the Senate. Langan predicts the chances of the border tax being enacted at less than 50 percent.

The proposal to begin levying companies’ imports and domestic sales and make exports tax-exempt would completely overhaul the U.S. tax code.

News

Armored Tesla Cybertruck “War Machine” debuts at Defense Expo 2025

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Temporibus autem quibusdam et aut officiis debitis aut rerum necessitatibus saepe eveniet ut et voluptates repudiandae sint et molestiae non recusandae. Itaque earum rerum hic tenetur a sapiente delectus, ut aut reiciendis voluptatibus maiores alias consequatur aut perferendis doloribus asperiores repellat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

“Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat”

Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed quia consequuntur magni dolores eos qui ratione voluptatem sequi nesciunt.

Et harum quidem rerum facilis est et expedita distinctio. Nam libero tempore, cum soluta nobis est eligendi optio cumque nihil impedit quo minus id quod maxime placeat facere possimus, omnis voluptas assumenda est, omnis dolor repellendus.

Nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem. Ut enim ad minima veniam, quis nostrum exercitationem ullam corporis suscipit laboriosam, nisi ut aliquid ex ea commodi consequatur.

At vero eos et accusamus et iusto odio dignissimos ducimus qui blanditiis praesentium voluptatum deleniti atque corrupti quos dolores et quas molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia deserunt mollitia animi, id est laborum et dolorum fuga.

Quis autem vel eum iure reprehenderit qui in ea voluptate velit esse quam nihil molestiae consequatur, vel illum qui dolorem eum fugiat quo voluptas nulla pariatur.

News

Tesla Megapacks chosen for 548 MWh energy storage project in Japan

Tesla plans to supply over 100 Megapack units to support a large stationary storage project in Japan, making it one of the country’s largest energy storage facilities.

Tesla’s Megapack grid-scale batteries have been selected to back an energy storage project in Japan, coming as the latest of the company’s continued deployment of the hardware.

As detailed in a report from Nikkei this week, Tesla plans to supply 142 Megapack units to support a 548 MWh storage project in Japan, set to become one of the country’s largest energy storage facilities. The project is being overseen by financial firm Orix, and it will be located at a facility Maibara in central Japan’s Shiga prefecture, and it aims to come online in early 2027.

The deal is just the latest of several Megapack deployments over the past few years, as the company continues to ramp production of the units. Tesla currently produces the Megapack at a facility in Lathrop, California, though the company also recently completed construction on its second so-called “Megafactory” in Shanghai China and is expected to begin production in the coming weeks.

READ MORE ON TESLA MEGAPACKS: Tesla Megapacks help power battery supplier Panasonic’s Kyoto test site

Tesla’s production of the Megapack has been ramping up at the Lathrop facility since initially opening in 2022, and both this site and the Shanghai Megafactory are aiming to eventually reach a volume production of 10,000 Megapack units per year. The company surpassed its 10,000th Megapack unit produced at Lathrop in November.

During Tesla’s Q4 earnings call last week, CEO Elon Musk also said that the company is looking to construct a third Megafactory, though he did not disclose where.

Last year, Tesla Energy also had record deployments of its Megapack and Powerwall home batteries with a total of 31.4 GWh of energy products deployed for a 114-percent increase from 2023.

Other recently deployed or announced Megapack projects include a massive 600 MW/1,600 MWh facility in Melbourne, a 75 MW/300 MWh energy storage site in Belgium, and a 228 MW/912 MWh storage project in Chile, along with many others still.

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send us tips at tips@teslarati.com.

Tesla highlights the Megapack site replacing Hawaii’s last coal plant

Need accessories for your Tesla? Check out the Teslarati Marketplace:

News

Elon Musk responds to Ontario canceling $100M Starlink deal amid tariff drama

Ontario Premier Doug Ford said, opens new tab on February 3 that he was “ripping up” his province’s CA$100 million agreement with Starlink in response to the U.S. imposing tariffs on Canadian goods.

Elon Musk company SpaceX is set to lose a $100 million deal with the Canadian province of Ontario following a response to the Trump administration’s decision to apply 25 percent tariffs to the country.

Starlink, a satellite-based internet service launched by the Musk entity SpaceX, will lose a $100 million deal it had with Ontario, Premier Doug Ford announced today.

Starting today and until U.S. tariffs are removed, Ontario is banning American companies from provincial contracts.

Every year, the Ontario government and its agencies spend $30 billion on procurement, alongside our $200 billion plan to build Ontario. U.S.-based businesses will…

— Doug Ford (@fordnation) February 3, 2025

Ford said on X today that Ontario is banning American companies from provincial contracts:

“We’ll be ripping up the province’s contract with Starlink. Ontario won’t do business with people hellbent on destroying our economy. Canada didn’t start this fight with the U.S., but you better believe we’re ready to win it.”

It is a blow to the citizens of the province more than anything, as the Starlink internet constellation has provided people in rural areas across the globe stable and reliable access for several years.

Musk responded in simple terms, stating, “Oh well.”

Oh well https://t.co/1jpMu55T6s

— Elon Musk (@elonmusk) February 3, 2025

It seems Musk is less than enthused about the fact that Starlink is being eliminated from the province, but it does not seem like all that big of a blow either.

As previously mentioned, this impacts citizens more than Starlink itself, which has established itself as a main player in reliable internet access. Starlink has signed several contracts with various airlines and maritime companies.

It is also expanding to new territories across the globe on an almost daily basis.

With Mexico already working to avoid the tariff situation with the United States, it will be interesting to see if Canada does the same.

The two have shared a pleasant relationship, but President Trump is putting his foot down in terms of what comes across the border, which could impact Americans in the short term.