Investor's Corner

Venture capitalist defends Tesla and Elon Musk, issues bold takedown on TSLA skeptics

There are a lot of reasons why Tesla (NASDAQ:TSLA) is fighting an uphill battle. The company is changing the status quo in both the auto industry and in the emerging autonomous driving market. Its CEO, Elon Musk, continues to be a polarizing figure for many. These, together with the mass numbers of short-sellers betting on the company’s failure, makes Tesla a dramatic stock in the market; and this became evident in the aftermath of the company’s first quarter financial results and earnings call.

Venture capitalist Chamath Palihapitiya, an early investor in Facebook who is estimated to be worth around $1.2 billion today, believes that many are missing the whole point about Tesla. In a segment with CNBC Halftime Report host Scott Wapner, Palihapitiya explained why he fully supports Tesla, its vehicles like the Model 3, and its CEO, Elon Musk. A video of the venture capitalist’s segment has been cut from CNBC’s uploads of the interview, though copies of the footage have been saved by some members of the Tesla community since it aired (credit to @TradrFloridaFIL for providing the video and transcription of the interview).

Palihapitiya starts by arguing that Elon Musk has already completed endeavors that will benefit humanity for a long time to come, citing the reusable rockets of SpaceX, which have brought the costs of spaceflight down significantly. The venture capitalist notes that Tesla is now maturing under all the demand for its vehicles, particularly the Model 3, which has brought the company closer than ever to the mass market. While Palihapitiya admits that Tesla is not best-suited for investors who are particular with quarter-over-quarter precision, he argues that the company has nonetheless impressed on the long term.

The venture capitalist also expressed his criticism of Tesla skeptics, mainly hedge funds, who are proficient at under-hyping and “sniping” the electric car maker. This is something that has weighed down the company over the past quarters, and has caused CEO Elon Musk to respond personally to critics online. “What it’s controlled by are a bunch of vulture-like venture and hedge funds, mostly hedge funds who like to prey on that company. If you look at for example the Twitter traffic or if you look at the forum traffic around Tesla the amount of hyping or under-hyping the amount of sniping is enormous. All of that signals to me that it is a market that is out of the control of the founders and the executives and firmly in the hands of financial manipulators,” Palihapitiya said.

While Palihapitiya admits that Elon Musk has a problem with his overly-aggressive timeframes, the venture capitalist candidly noted that the world might be better off if Elon Musk were just allowed to “do his job.” “If you take a five-year step back and say what is he promised in 2014 to what is he doing in 2019 you’d be ecstatic. Similarly, if you take a step back and say from 2019 to 2024 let the man do his job, will we be better or worse off as a planet, as a species, as humanity, as consumers? Will we be better off?” he said.

A particular point of criticism for Elon Musk lies in his behavior online. Musk’s Twitter account could be considered as one of Tesla’s greatest assets or liabilities, in the way that its contents have triggered both positive and negative swings for TSLA stock. Tesla critics currently view Musk’s Twitter antics as a critical part of their bear thesis, particularly since his actions are allegedly not reflective of a CEO that is professional and in control. This was brought up by the CNBC host during the venture capitalist’s interview, and Palihapitiya was quick to issue a rebuttal. According to the billionaire, people that are caught up in concerns about Musk’s Twitter are missing the whole point, even considering the CEO’s now-infamous “funding secured” tweet.

“Okay, maybe he stepped out of bounds. My point is you’re getting caught up in the window dressing. I’m focusing on the main course. The main course is on the table. The choice for you as a buyer or a seller of that stock is, do you want to eat it? If you get caught up in all of the stuff around the edges, maybe he may mistweet from time to time. My point is, who cares? Your job as a smart investor is to separate the facts and the news from the fiction and the noise. And all of that stuff doesn’t matter. It does not change the fact that tens of thousands of consumers are buying that car faster than they can get their hands on it. It doesn’t change that the minute you sit inside that car, your definition of what is expected is altered forever and you wonder why every other car around you that you ever step in that you may buy doesn’t have the same things that that car offers. So at the end of the day, whether you like his style or not, his substance is irrefutable,” he said.

In response to the CNBC host’s question about the upcoming competition from veteran auto, the venture capitalist notes that at this point, it is evident that Tesla will be the “clear winner” in the electric car industry. This comment is not just blind support for Tesla, as even premium electric cars being produced by legacy auto today still fall short of the specs and capabilities of the company’s vehicles. Vehicles like the Audi e-tron, for example, feature more luxurious interior finishes than a Tesla Model 3, but when it comes to efficiency and software, the vehicles are years behind. Palihapitiya argues that even if Tesla reaches a point where it will need to be bailed out, larger companies like Apple or Google will likely acquire the electric car maker.

“You’re right because I remember all the Zune media players I bought after Apple released the iPod. I also remember the enormous number of amazing smartphones I bought when the iPhone was like… It’s not what people do. You know it tends to be the case that when you redefine expectations and you have a category leader, and you have an indelible brand and a mark that people recognize, the easiest decision. Let me be a little pejorative; the lazy decision is to pick the winner and go with it. And in this case there is a clear winner in electrification, it is done. That die has been cast. And so now the question is can he build the infrastructure to deliver the demand? And if given time and if given patience I believe he will and I vote with my money that he can do that.

“And everybody that bets against him can do that as well but at what stake really, because it’s not as if there’s no downside protection for the stock. The people who short this company are so short-sighted because the number of companies that would come out of the woodwork… You don’t think that Apple with 200 billion dollars of cash backstops this company and has a chance to enter a trillion dollar market overnight by buying that business if it gets imperiled in any way? Google which already tried to buy it wouldn’t try to buy it again? So what are we betting against? We’re betting against the cleaner earth because we don’t like that? We like to suck in the carbon monoxide and the fumes from all these cars? We’re betting against beautiful flat screens, beautiful ways in which to manage your experience inside the car because we don’t like that?” he said.

Ultimately, Palihapitiya argues that the bets against Tesla are usually bets against Elon Musk’s style. When the CNBC host brought up noted short-seller Jim Chanos and his stance against the electric car maker, the venture capitalist did not mince his words. “Jim Chanos makes money once a decade. And while the market rips up the guy just bleeds money, and he’s never on CNBC and every time something works he’s there for five minutes. Great for Jim Chanos, fantastic as a hedge in a portfolio where you have 1% in a short fund but the reality is being long equities makes sense. Being long innovation makes sense. Betting against entrepreneurs that are changing the world has never been a profitable endeavor. Why start now?” he said, adding that he will be happy to post his returns against Chanos’ fund any time when challenged once more by the CNBC host.

Watch Chamath Palihapitiya’s segment on CNBC’s Halftime Report in the video below.

Investor's Corner

Tesla is ‘better-positioned’ as a company and as a stock as tariff situation escalates

Tesla is “better-positioned” as a company and as a stock as the tariff situation between the United States, Mexico, and Canada continues to escalate as President Donald Trump announced sanctions against those countries.

Analysts at Piper Sandler are unconcerned regarding Tesla’s position as a high-level stock holding as the tariff drama continues to unfold. This is mostly due to its reputation as a vehicle manufacturer in the domestic market, especially as it holds a distinct advantage of having some of the most American-made vehicles in the country.

Analysts at the firm, led by Alexander Potter, said Tesla is “one of the most defensive stocks” in the automotive sector as the tariff situation continues.

The defensive play comes from the nature of the stock, which should not be too impacted from a U.S. standpoint because of its focus on building vehicles and sourcing parts from manufacturers and companies based in the United States. Tesla has held the distinct title of having several of the most American-made cars, based on annual studies from Cars.com.

Its most recent study, released in June 2024, showed that the Model Y, Model S, and Model X are three of the top ten vehicles with the most U.S.-based manufacturing.

Tesla captures three spots in Cars.com’s American-Made Index, only U.S. manufacturer in list

The year prior, Tesla swept the top four spots of the study.

Piper Sandler analysts highlighted this point in a new note on Monday morning amidst increasing tension between the U.S. and Canada, as Mexico has already started to work with the Trump Administration on a solution:

“Tesla assembles five vehicles in the U.S., and all five rank among the most American-made cars.”

However, with that being said, there is certainly the potential for things to get tougher. The analysts believe that Tesla, while potentially impacted, will be in a better position than most companies because of their domestic position:

“If nothing changes in the next few days, tariffs will almost certainly deal a crippling blow to automotive supply chains in North America. [There is a possibility that] Trump capitulates in some way (perhaps he’ll delay implementation, in an effort to save face).”

There is no evidence that Tesla will be completely bulletproof when it comes to these potential impacts. However, it is definitely better insulated than other companies.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla gets price target boost from Truist, but it comes with criticism

Tesla (NASDAQ: TSLA) received a price target boost from analysts at Truist Securities, but it came with some criticisms based on a lack of information on several things that investors were excited to hear about regarding future vehicles and AI achievements.

Last night, Tesla reported its earnings from the fourth quarter of 2024, and while it had a very tempered financial showing, missing most of the Wall Street targets that were set for it, the stock was up after hours and on Thursday due to the details the company released regarding its plans for 2025.

CEO Elon Musk stunned listeners last night by revealing plans to launch unsupervised Full Self-Driving as a service in Austin in June 2025. It will be the first time Tesla will offer driverless FSD rides in public, something it has been working with the City of Austin on since December.

Tesla to launch unsupervised Full Self-Driving as a service in Austin in June

It also reiterated plans for affordable models to be launched this year, potentially catalyzing annual growth in deliveries, something it said it expects to resume in 2025.

Tesla was flat on deliveries in 2024 compared to 2023.

The positives during the call were enough for Truist Securities analyst William Stein to raise the company’s price target to $373 from $351. However, Stein’s note to investors showed there was something to be desired despite all the good that was revealed during the call:

Stein said there was “not enough ground-truth” during the call and too much of a focus on “cheerleading” the company’s potential releases this year:

“Too much cheerleading; not enough ground-truth. In Q4, TSLA’s ASP weakness drive revenue, GPM, OPM, & EPS below consensus.”

As previously mentioned, Tesla did report weak financials that missed consensus estimates. What saved the call and perhaps the stock from plummeting on these missed metrics was the other details that Musk revealed, especially the FSD launch in Austin in June.

There were also plenty of things related to the affordable models and other vehicles, like the fact that Tesla plans to include things like Steer by Wire, Adaptive Air Suspension, and Rear Wheel Steering, that helped offset negatives.

Stein saw this as a distraction from what should have been reported:

“While CEO Elon Musk played the role of cheerleader, calling for TSLA’s path to massive market cap by leading in autonomy, management was remarkably short on two critical details: (1) info about new vehicles in 2025 and (2) milestones for AI acheivements, especially FSD. We continue to ask ourselves ‘where’s the beef?’ CY26 EPS to $3.99 (from $4.87). DCF-derived PT to $373 (from $351).”

Tesla did detail some AI milestones, like its record-breaking miles per accident on Autopilot, which was a Q4-best of 5.94 million miles. The Shareholder Deck also outlined major upgrades to AI:

“In Q4, we completed the deployment of Cortex, a ~50k H100 training cluster at Gigafactory Texas. Cortex helped enable V13 of FSD (Supervised)1, which boasts major improvements in safety and comfort thanks to 4.2x increase in data, higher resolution video inputs, 2x reduction in photon-to-control latency and redesigned controller, among other enhancements.”

Tesla shares are up 2.11 percent on Thursday as of 12:05 p.m. on the East Coast.

Need accessories for your Tesla? Check out the Teslarati Marketplace:

- https://shop.teslarati.com/collections/tesla-cybertruck-accessories

- https://shop.teslarati.com/collections/tesla-model-y-accessories

- https://shop.teslarati.com/collections/tesla-model-3-accessories

Please email me with questions and comments at joey@teslarati.com. I’d love to chat! You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Investor's Corner

Tesla posts Q4 2024 vehicle safety report

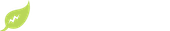

Tesla has released its Q4 2024 vehicle safety report. Similar to data from previous quarters, vehicles that were operating with Autopilot technology proved notably safer.

The Q4 2024 report:

- As per Tesla, it recorded one crash for every 5.94 million miles driven in which drivers were using Autopilot technology.

- The company also recorded one crash for every 1.08 million miles driven for drivers who were not using Autopilot technology.

- For comparison, the most recent data available from the NHTSA and FHWA (from 2023) showed that there was one automobile crash every 702,000 miles in the United States.

Previous safety reports:

- In Q3 2024, Tesla recorded one crash for every 7.08 million miles driven in which drivers were using Autopilot technology and one crash for every 1.29 million miles driven by drivers not using Autopilot technology.

- In Q2 2024, Tesla recorded one crash for every 6.88 million miles driven in which drivers were using Autopilot technology, and one crash for every 1.45 million miles driven for drivers not using Autopilot technology.

- In Q1 2024, Tesla recorded one crash for every 7.63 million miles driven in which drivers were using Autopilot technology, and one crash for every 955,000 million miles driven for drivers not using Autopilot technology.

Year-over-Year Comparison:

- In Q4 2023, Tesla recorded one crash for every 5.39 million miles driven in which drivers were using Autopilot technology and one crash for every 1.00 million miles driven for drivers not using Autopilot technology.

Key background:

- Tesla began voluntarily releasing quarterly safety reports in October 2018 to provide critical safety information about our vehicles to the public.

- On July 2019, Tesla started voluntarily releasing annual updated data about vehicle fires as well.

- It should be noted that accident rates among all vehicles on the road can vary from quarter to quarter and can be affected by seasonality, such as reduced daylight and inclement weather conditions.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.